Personal Wealth Management / Market Analysis

On Inflation, Trust the Market

Whilst we don’t think any indicator is perfect, our research shows the market is usually right a lot more often than the zeitgeist.

If we could pick one word to sum up the collective reaction to the December US inflation rate report, it would be ouch. The US Consumer Price Index (CPI, a government-produced measure of goods and services prices across the broad economy) accelerated to 7.0% y/y—the fastest rate since 1982.[i] Many commentators we follow warn elevated inflation will pose problems for US stocks, affecting global returns given the US represents nearly 70% of MSCI World Index market capitalisation and US stocks have a high correlation with stocks outside America.[ii] Yet they also said this last year, even as global markets rose much faster than consumer prices.[iii] In our view, this is critical to remember as inflation warnings remain in headlines.

We have observed that inflation has morphed into a hot button political issue globally. So please understand that when we discuss inflation and its stock market implications, we aren’t making ideological or political statements. Our research shows stocks don’t view things in terms of good or bad in the absolute sense. In our view, that debate is squarely in the human, societal realm. For stocks, we think the question is at once more simple and more complex: Is there any material trouble left that markets haven’t already priced in, or incorporated into share prices? Is there any negative surprise power left? A strong likelihood of a bad outcome that investors haven’t already considered?

That last question is the key, in our view. We realise it is almost cliché to say markets are efficient and forward-looking, so please don’t get annoyed with us for going there. But overwhelmingly, our research has found that in any sufficiently liquid market, be it stocks, bonds or what have you, prices generally reflect all widely known information at any given time. Information includes facts, figures and data. It also includes interpretations of those facts, figures and data, and the hopes and fears that emerge from that analysis. Moreover, it includes forecasts, which, in our view, are really just opinions on how said facts, figures and data will likely evolve in the future—and, perhaps, what that evolution could mean for asset prices.

Now, we think no one can prove this scientifically, beyond a shadow of a doubt. But simple logic and reason can get us close enough, in our view: People buy and sell constantly, with heads full of knowledge, viewpoints, biases and forecasts. Since last April, when the US Bureau of Labor Statistics announced the CPI inflation rate crossed above 2.0% for the first time in a while, investors continued buying and selling stocks and bonds with full knowledge of inflation’s acceleration.[iv] In more recent months, given how prolific they are in headlines, supply chain issues have likely loomed large in the market’s hive mind, as has the US Federal Reserve’s (Fed) decision to stop using the word “transitory” to describe accelerating inflation.[v] We think this shift was an attempt to be more clear, but most financial commentators we follow interpreted it as a public confession that the Fed’s earlier views were likely wrong. Thus, the prospect of inflation staying higher for longer became the dominant view amongst many commentators. Now it seems the end of the Fed’s quantitative easing (QE) asset purchases looms large, as do potential short-term interest rate hikes. All of which we have found people generally view quite negatively. In our view, it is fair to infer this pessimism has played into the purchase or sale prices so many investors have decided to accept, whether consciously or not.[vi] Therefore, we think we can reason that these fears are all reflected in prices, also known as being priced in.

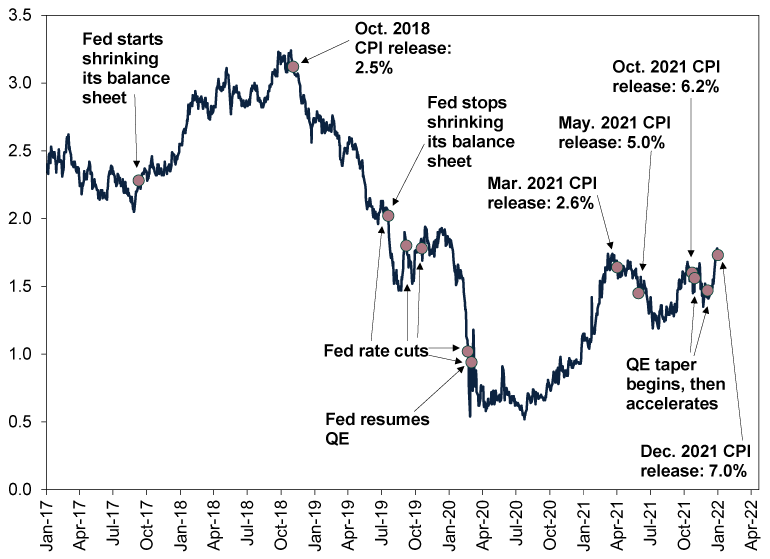

In our view, stocks move on political as well as economic drivers, so some could argue there are too many confounding variables to use stocks’ big 2021 as a counterpoint to inflation fears.[vii] Yet, we think the counterfactual—how stocks would be faring if inflation were milder—is also unknowable. But our research shows bonds have a more direct relationship with inflation, which erodes the future value of fixed interest payments as well as the bond’s face value at maturity. So in general, in our view, the higher the expected inflation rate, the higher the interest rate investors will likely charge to preserve purchasing power. If inflation were likely to stay high enough for long enough to cause big problems, we think we would see it in elevated long-term US Treasury bond yields. Yet, much as financial commentators we follow are hyping the new year’s recent yield climb, as Exhibit 1 shows, the 10-year Treasury yield hasn’t jumped alongside the inflation rate. As you will see, it actually fell for a good four months as the inflation rate accelerated past 5.0%. Following a brief uptick, it fell again as the Fed started reining in QE, a development many financial commentators argued would bring higher rates. Even with the recent uptick, Friday’s 1.78% 10-year yield is right around where it was in late March 2021, when the inflation rate was much, much lower.[viii]

Exhibit 1: 10-Year US Treasury Yield, the Fed and Inflation

Source: FactSet and US Federal Reserve, as of 12/1/2022. 10-year US Treasury yield (constant maturity), 12/1/2017 – 12/1/2022.

In our view, it is quite fair to say the market knows US inflation hit 7.0% last month given how many headlines the news generated. Furthermore, we think it likely priced that outcome well before Wednesday’s data confirmed it. Our research shows it generally knows people worry about the implications. Yet, in our view, it also knows that the culprit most apparent in the data—the supply chain crisis—is starting to ease up.[ix] We think it knows people surveyed in December purchasing managers’ indexes across the US and Europe reported cost and logistics pressures are starting to moderate.[x] In our view, it has seen numerous businesses’ reported investments in increased capacity and their own supply chains. And we think it has seen the inflation math evolve over the past year, so we think it probably knows that in a few months, lockdown-deflated early-2021 prices will be out of the denominator in the year-over-year calculation, removing the funky math helping skew the inflation rate higher in 2021’s second half. In our view, it has seen all of this and, based on where yields are, we think it has decided inflation isn’t a major problem for stocks. In our view, this is coming from the most efficient pricing and forecasting mechanism on earth.

Whilst our research shows markets can be inefficient in the short-term—this is where corrections (sentiment-driven declines of around -10% to -20%) and bubbles alike come from—we don’t think it is in markets’ nature to ignore something as big as inflation for over half a year. So, in our view, the most rational conclusion when the hype says one thing and the market says another is that the market is probably right. If it knows where inflation is and how people and businesses are responding to it and long-term yields aren’t soaring, we think that is a powerful signal. We suggest taking a deep breath, and trusting it.

[i] Source: FactSet, as of 12/1/2022.

[ii] Source: Global Financial Data, Inc., as of 5/1/2022. Market capitalisation is a measure of a firm or equity market’s size, calculated by multiplying share price times shares outstanding. US market capitalisation as a percentage of MSCI World Index market capitalisation on 3/1/2022. Statement based on the correlation coefficient between the S&P 500 and MSCI World Ex. USA Index price returns in local currencies. The correlation coefficient is a statistical measure of the directional relationship between two variables. A correlation of 1.0 implies lockstep movement, 0 implies no relationship, and -1.0 implies the variables move in opposite directions. Currency fluctuations between the dollar and franc and euro and other international currencies may result in higher or lower investment returns.

[iii] Source: FactSet, as of 13/1/2022. Statement based on MSCI World Index return in GBP with net dividends, 31/12/2020 – 31/12/2021.

[iv] See Note i.

[v] “Fed Chairman Jerome Powell Retires the Word ‘Transitory’ in Describing Inflation,” Brian Cheung, Yahoo! Finance, 30/11/2021.

[vi] Source: FactSet, as of 13/1/2022. Statement based on Consumer Price Indexes in the US, UK and Eurozone.

[vii] See Note iii.

[viii] Source: FactSet and US Federal Reserve, as of 14/1/2022. 10-year US Treasury yield (constant maturity), 31/12/2016 – 14/1/2022.

[ix] Source: FactSet, as of 13/1/2022. Global Air Freight and US Maritime Shipping Price Indexes, y/y price change, monthly, 31/12/2018 – 30/11/2021.

[x] Source: IHS Markit and Institute for Supply Management as of 13/1/2022.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Markets Are Always Changing—What Can You Do About It?

Get tips for enhancing your strategy, advice for buying and selling and see where we think the market is headed next.