Our Investment Process

Assess Importance and Refine

Our Investment Policy Committee (IPC), supported by our Securities and Capital Markets Analysts, determines the materiality of the ESG considerations based on the exposure among publicly traded companies in these categories. Higher materiality could imply larger ESG-related risks or opportunities, and may influence sector and country weight preferences as well as individual stock selection.

Fisher Investments is able to refine prospective equity lists further by applying the firm’s or client-provided responsible investing screens to the list of prospective securities for separately managed accounts.

How Does Our Top-Down Process Benefit ESG Investors?

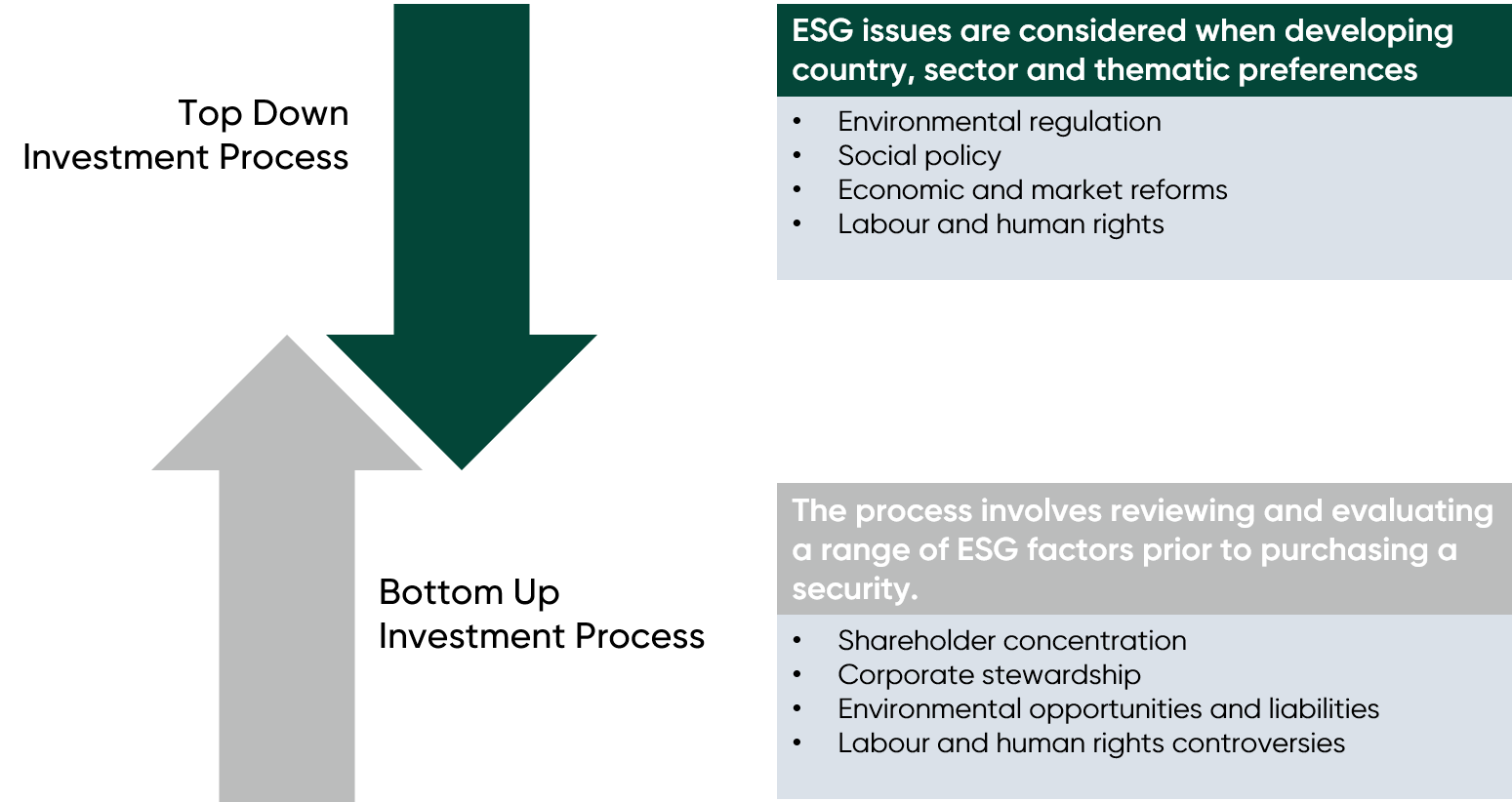

Fisher Investments believes that asset allocation and sub-asset allocation decisions are critical to long-term investment success and that our top-down investment process is particularly well suited to building successful responsible investing portfolios.

We believe ESG investors are best served by an investment process that considers both top-down and bottom-up factors. Integrating ESG analysis at the country, sector and stock levels consistent with clients’ investment goals and ESG policies increases the likelihood of achieving desired performance and improving environmental and social conditions worldwide.

Contact us to learn more about our ESG strategies.

Learn more about our ESG strategies todayESG Policy Statement

Learn more about how Fisher Investments considers ESG factors throughout our investment process.

Download Our PDF