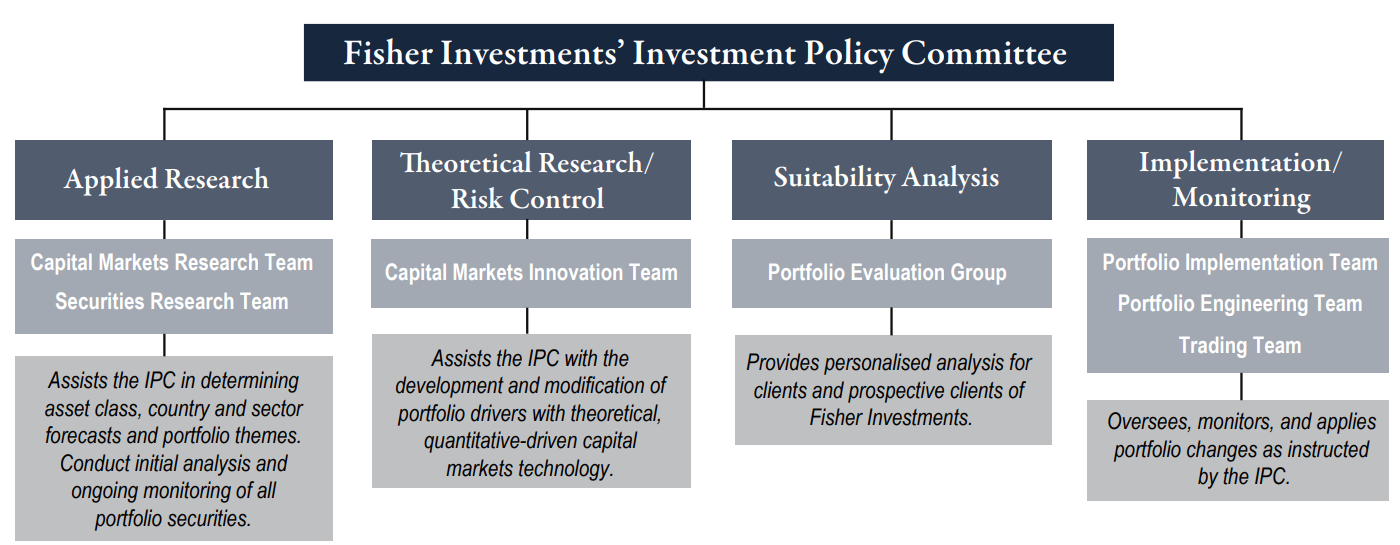

Responsibilities of Fisher Investments’ Research Group

Each team has unique responsibilities, including analysing economic trends, updating sector and industry analyses, evaluating securities, calculating performance and implementing the IPC's portfolio decisions.

Applied Research

Two Applied Research teams, the Capital Markets Research Team and the Securities Research Team, provide information and analysis upon which the IPC makes portfolio decisions. Both teams have dedicated analysts specializing in fixed income research.

Capital Markets Research Team

The Capital Markets Research Team employs a top-down investment process to understand economic, political and sentiment factors that Fisher Investments believes will drive markets over the next 12-18 months. The IPC uses this information to develop key portfolio themes based on which asset classes, countries and sectors are best positioned for the economic environment we expect ahead.

Securities Research Team

The Securities analysts perform fundamental research on current and prospective investments to identify securities with strategic attributes consistent with our top-down views and competitive advantages relative to their defined peer group.

Portfolio Implementation & Monitoring

Implementation Team

The Implementation Team oversees and applies portfolio changes—generating trade orders—as instructed by the IPC, portfolio strategy and client restrictions.

Portfolio Engineering Team

The Portfolio Engineering Team monitors strategies to ensure the intended portfolio themes are represented.

Trading Team

The Trading Team works together with the Portfolio Implementation Team to generate and execute trade orders as directed by the IPC.