Personal Wealth Management / Market Analysis

Deal or No Deal, Iran Likely Doesn’t Sway Global Energy Markets

Compared to global oil supply and demand forces, America’s withdrawal from the Iran nuclear accord is mostly a sideshow.

Last Tuesday, President Trump announced the United States’ withdrawal from the Joint Comprehensive Plan of Action, better known as the Iran nuclear deal. Under the agreement—which the US, UK, Iran, Russia, China and the EU signed in July 2015—Iran agreed to scale back its nuclear activity and accept international inspections to monitor compliance in exchange for the removal of sweeping economic sanctions in place since 2012. While a lot of the discussion focuses on how the decision might affect Iran’s nuclear ambitions, this is a long-term question—not super relevant for stocks, which focus most on the next 3 – 30(ish) months. Others, though, touted an immediate economic takeaway: higher oil prices as renewed sanctions slash Iran’s contribution to global supply. But while talk of the US’s likely withdrawal may have contributed to the recent oil price uptick, this strikes us more as short-term commodity price volatility than the start of a sustained march upwards. In our view, global supply and demand forces likely overwhelm the deal’s impact on Iranian oil shipments. Presently, these forces appear roughly balanced, arguing against huge price swings in the near future.

Predictions for plummeting Iranian production strike us as premature for a couple reasons. First, the US government hasn’t announced details on potential sanctions’ scope or strictness. They wouldn’t go into effect for three to six months (depending on the activity involved)—perhaps allowing time for negotiations or even a revised deal lifting them. Treasury Secretary Steven Mnuchin’s call for “a new deal” could turn out to be mere words, but given the Trump administration’s penchant for threatening huge changes before watering them down, we wouldn’t rule out further talks or a compromise just yet.

Sanctions’ impact on Iranian oil exports also depends on how other countries—particularly in Europe—respond. The US hasn’t imported Iranian oil since 1991, so nothing changes there. The EU wants to preserve the deal and nascent Iranian trade ties, but US sanctions might thwart this by penalizing banks (based in the US or elsewhere) that finance investments in Iran or handle dollar-based payments between Iranian and outside businesses. This includes oil contracts: As one oil industry exec explained, “We’re all backed by European banks who are not going to provide any financing for trades with Iran, even if we wanted to.”

Non-European purchases could also pick up some of the slack in the short term—Iran’s top oil export destinations last year were China and India, which are tougher nuts for US sanctions to crack. However, beyond possibly curtailing European purchases of Iranian oil, the restrictions could cut off the capital needed to invest in new or existing oil fields, reducing production down the road. But even if sanctions take a huge bite out of Iran’s 2.5 million barrels per day (bpd) export pace (or 3.8 million bpd in total production), the impact on global supply is likely minor. Recent history shows this: When Europe was participating in US-led sanctions between 2012 – 2016, Iranian exports to Europe fell about 1 million bpd.

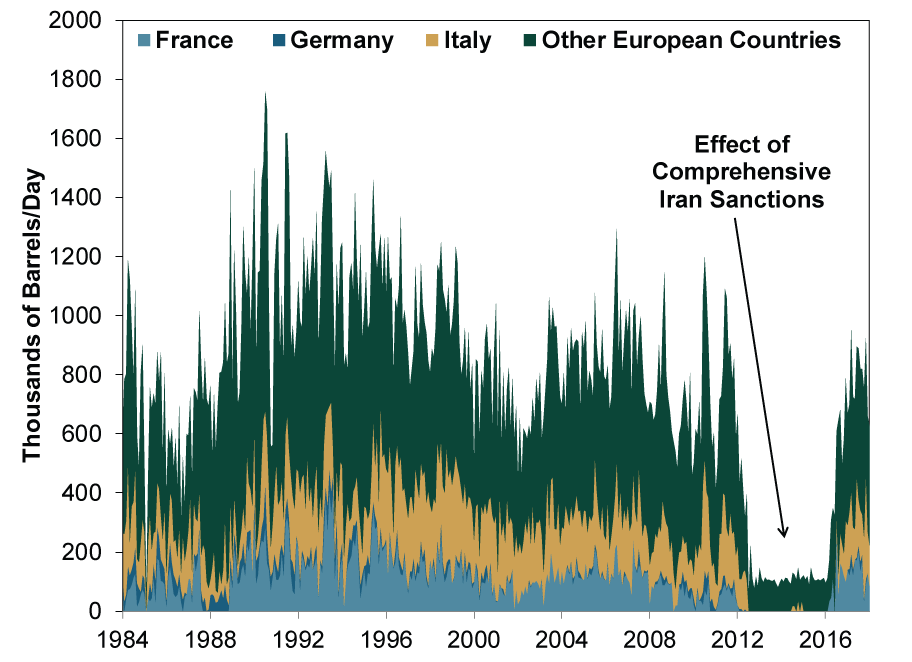

Exhibit 1: Previous Sanctions Sliced Iran’s Oil Exports to Europe

Source: Energy Information Administration, as of 5/9/2018. Iranian oil exports to Europe, January 1984 – January 2018.

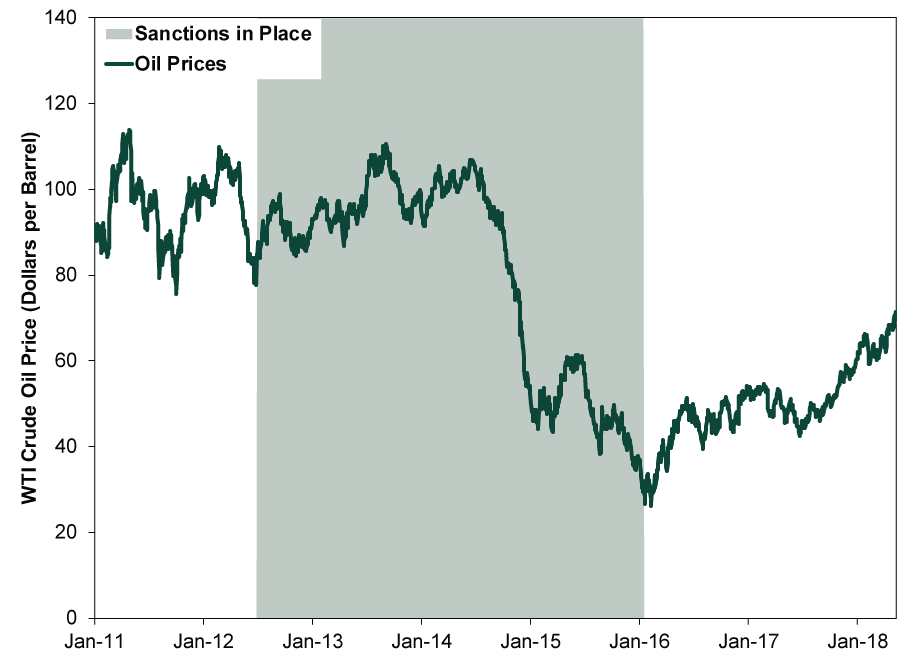

But during this time, global oil production rose—from about 76 million bpd in July 2012 (when sanctions intensified via a European embargo of Iranian oil exports) to about 81.5 million bpd in January 2016 (when most sanctions were lifted).[i] Oil prices plummeted in 2014 as US shale producers fueled a global glut (pun intended), while the post-sanctions surge in Iranian oil output coincided with mostly rising prices. (Exhibit 2) This shows Iran has less influence on global oil production and prices than many believe.

Exhibit 2: Oil Prices Fall During Iran 2012 – 2016 Sanctions, Rise After

Source: FactSet, as of 5/14/2018. Crude Oil Prices: West Texas Intermediate, 1/3/2011 – 5/11/2018.

It is certainly possible Iran’s oil market heft has grown since then—maybe global oil demand has risen enough (or inventories are sufficiently low) that even relatively small supply shifts can sway prices. But this is far from assured—and even if present, the effect could be tiny. Should sanctions prove ironclad and Iranian exports again fall by 1 million bpd—the upper end of most present estimates—this would still pale next to 81 million bpd in global output.[ii] To use a horrific metaphor, that is a drop in the ocean.

That output isn’t static, either. US shale output is growing, with more supply than pipelines can handle presently. Thus far this year, US oil supply has risen by 865,000 bpd—possibly more than enough to offset potential Iranian cuts already—and more waits in the wings in abundant “drilled but uncompleted” wells. The US Energy Information Administration estimates US crude production will rise 1.3 million bpd in 2018 (to 10.7 million bpd). Moreover, OPEC production cut compliance may slip, especially if Saudi Arabia—which opposed the Iran deal—follows through on a promise to boost output to make up for any lost Iranian oil shipments.

So whether (still hypothetical) sanctions are airtight or leaky, we believe those anticipating oil output will plummet and send prices skyward, bringing massive profits across the Energy sector, will probably be disappointed. Since Iran isn’t a global swing producer, broader, more global supply and demand trends probably have larger influence. These seem relatively stable, likely preventing huge oil swings in either direction. Within the Energy sector, the environment probably still favors big, integrated global producers focusing on conventional and US shale wells, where breakeven prices are lower thanks to drilling tech advancements.

[i] Source: FactSet, as of 5/11/2018.

[ii] Source: Energy Information Administration, as 5/11/2018. World crude oil and lease condensate production, 2017.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.