Money Better Spent

Our advisory model maximizes for value generation, so less of your fee goes to non-wealth-generating services.

Get Your Free Fee Analysis

Wealth-Generating Fees

Adviser | Wealth-Generating

Fisher never accepts commissions, always putting your interests first. Some plans pay 3x more on fund fees because many brokers/advisors select funds that pay higher commissions.

Non-Wealth-Generating Fees

| Industry Average | Fisher Average | |

|---|---|---|

| Total Fee Percentage | 1.49%Information supported by footnote 4 | 1.40%Information supported by footnote 4 |

| Wealth Generating | 57% | 76% |

| Non-Wealth-Generating | 43% | 24% |

| Legend | Green color: Wealth GeneratingInformation supported by footnote 5 | Blue color: Non-Wealth-Generating |

First Class for the Price of Economy

We are champions for the needs of small businesses. And because we specialize in small business retirement plans, we have the knowledge, resources and clout to help you get more out of your vendors without increasing costs. It’s like moving from economy to first class at little or no additional cost.

The Fisher Advantage

Contact Us for a Complimentary Plan Analysis

Fee Analysis

We break down your existing plan fees—how much you pay and to whom—and compare them to the industry average and what you could be paying with Fisher.

Download Sample ReportPlan Benchmarking

We benchmark the fees and services of your plan relative to similar plans in the industry.

Download Sample ReportPlan Design Analysis

We analyze your current plan features, and help you understand how these features work.

Plan Design AnalysisPlan Illustration

We do customized projections showing what a particular plan type could look like for your specific business (including cost-benefits).

Download Sample ReportInvestment Analysis

Receive an analysis of the quality and cost of your existing lineup and how it compares to industry benchmarks, and what you could be paying with Fisher.

Download Sample Report

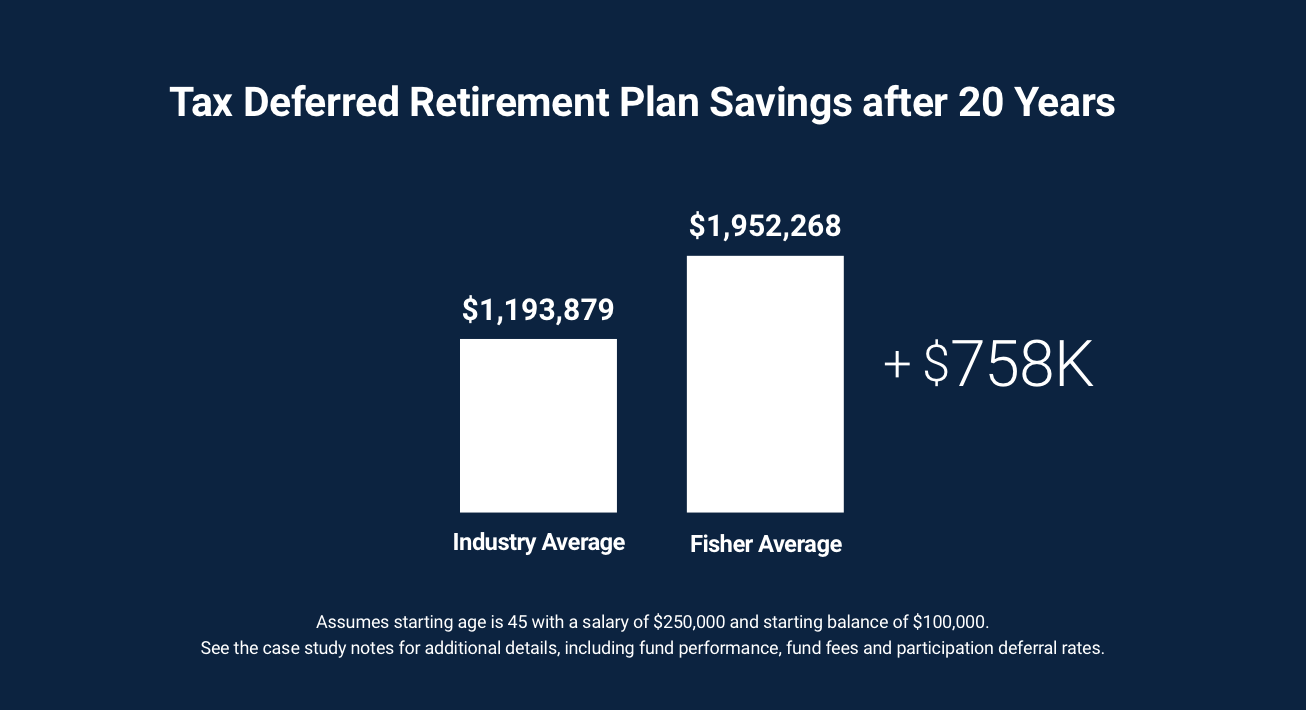

1 Average increase in employee participation rates as of 12/31/21

2 Average increase in employee contribution rates as of 12/31/21

3 The fund fees calculation is based on data gathered for 500+ retirement plans considering hiring Fisher between January 2022 and June 2022. Improvement is measured by taking the mean of the actual fees paid by the prospect to fund investment managers for their existing fund lineup and comparing it to the mean of the estimated fund fees of the Fisher proposed fund lineup.

4 Industry Average data is based on Fiduciary Benchmarks, Inc Plan Profile Report for a $2mil 401(k) plan with 50 participants as of 12/31/20, The Industry Average fund fee (.48%) was calculated by taking 32% of the industry average total plan fees (1.49%), as this is the average proportion of the fee allocated to investment managers in the report. The Fisher Average fee (1.40%) represents the fees an average Fisher Investments 401(k) client would pay as of 12/31/20, based on a $2mil 401(k) plan with 50 participants; Ascensus for bundled recordkeeping (.33%); and the weighted average fund expense ratio based on actual client investment allocations (.07%).

5 Wealth-generating fees are defined as plan advisor fees & fund fees; non-wealth generating fees are defined as all other fees, including recordkeeper and third party administrator fees.