How a Cash Balance Plan Works

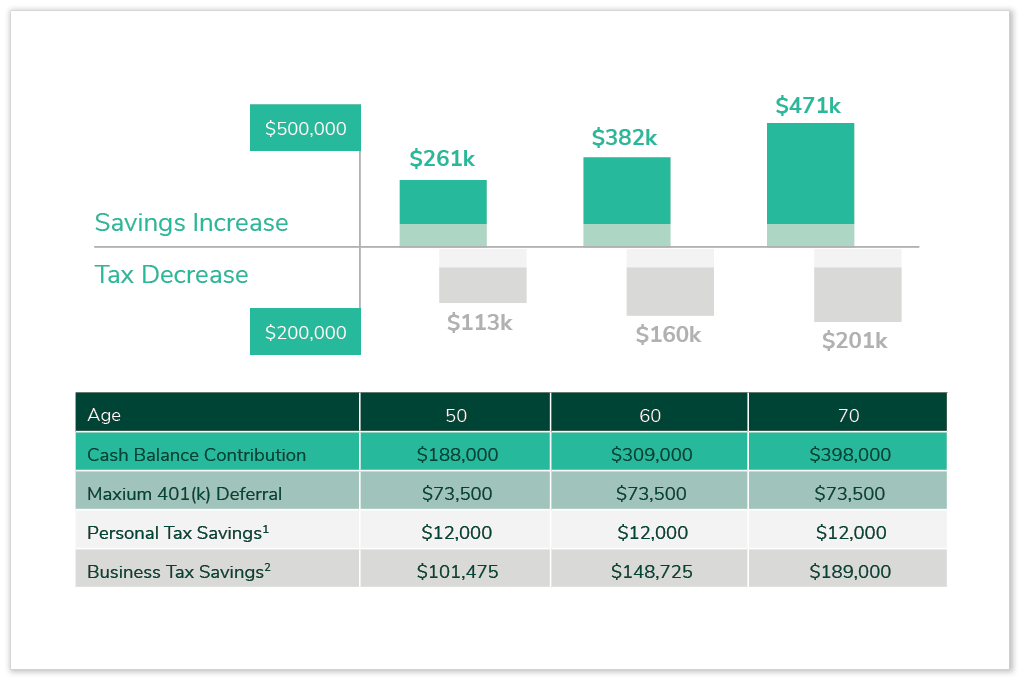

There's a huge tax benefit that likely no one has told you about. By maximizing your savings and tapping into additional plan features that multiply your tax benefits, you can save up to $100K or more1 on your tax bill. See why many successful business owners have added a cash balance plan to their company's 401(k) program.

What is a Cash Balance Plan

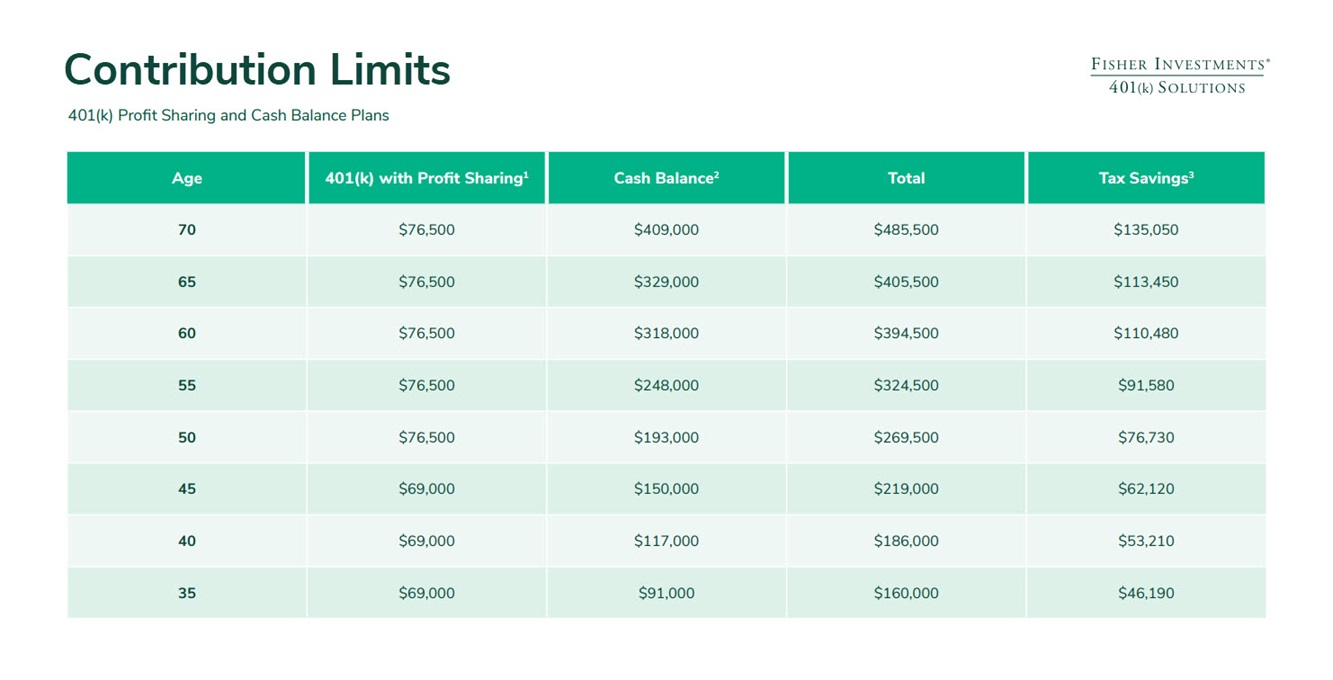

A cash balance plan is a type of retirement plan that allows business owners to contribute up to $480,500 per year. It’s sometimes called a cash balance pension plan because it's a defined benefit plan, meaning contributors are guaranteed a specified amount in retirement.

Why it's Important

A cash balance plan allows owners to keep more of their profits and grow them tax-deferred. And because it’s a business expense, a cash balance plan can significantly reduce a company’s business taxes. In fact, owners can fund a sizable portion of retirement savings using money they would have paid in taxes.

How Fisher Can Help

Cash balance retirement plans can be complex and require a plan advisor with deep expertise. Fisher is one of America's top advisory firms with experience helping many business owners set up and manage this sophisticated strategy.

Must-See 2-Minute Video

Cash Balance 101 for Business Owners

Are you missing out on tax advantaged savings? Many business owners don’t yet know about the massive tax benefits a cash balance retirement plan can offer. Watch this short video from a Fisher small business specialist to learn how a cash balance program may help you.

Results

CASH balance plans

Additional Resources

10 Essential Cash Balance Questions

If you run a successful business with steady revenue, you can save more for retirement while cutting your personal and business income taxes. Read this article to learn how.

Tax Savings Strategies

There’s a huge tax benefit for businesses that no one may have told you about. Some business owners can save up to $100K or more in taxes annually, by using three IRS sanctioned tax strategies.

Tax Benefits for Business Owners

Tax strategies are important for any employer, but especially for the owners of small and mid-sized businesses looking to make the most of every dollar.