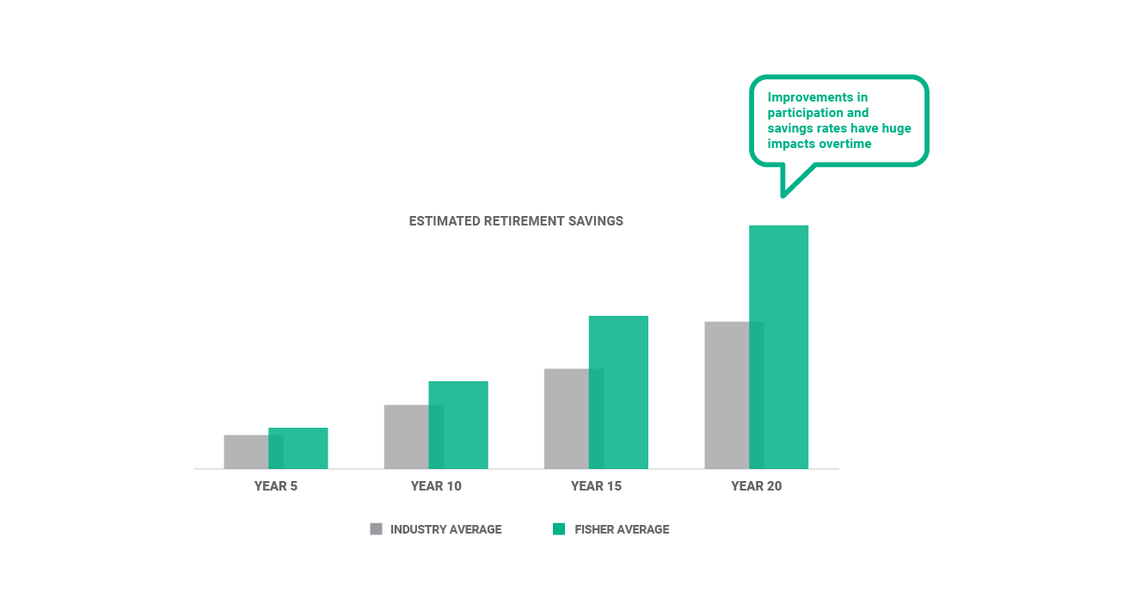

1% More Can Mean 15+ Extra Years of Spending

Improving your investment performance by just 1% can make a huge difference in your retirement savings.

Heads Up!

This tool works best when using a desktop computer

Reset form?

This will completely remove all fund tickers and you will need to reenter them.

GET YOUR FREE INVESTMENT REPORT

Are your funds maximized for investment performance? Find out how your funds stack up by using our tool to download your free personalized report.

MUST-SEE 3-MINUTE VIDEO

Hear How Fisher Can Help You Maximize Your Company's Retirement Plan

Watch this video to learn tips from a Fisher specialist about how to maximize your company's retirement plan for performance.

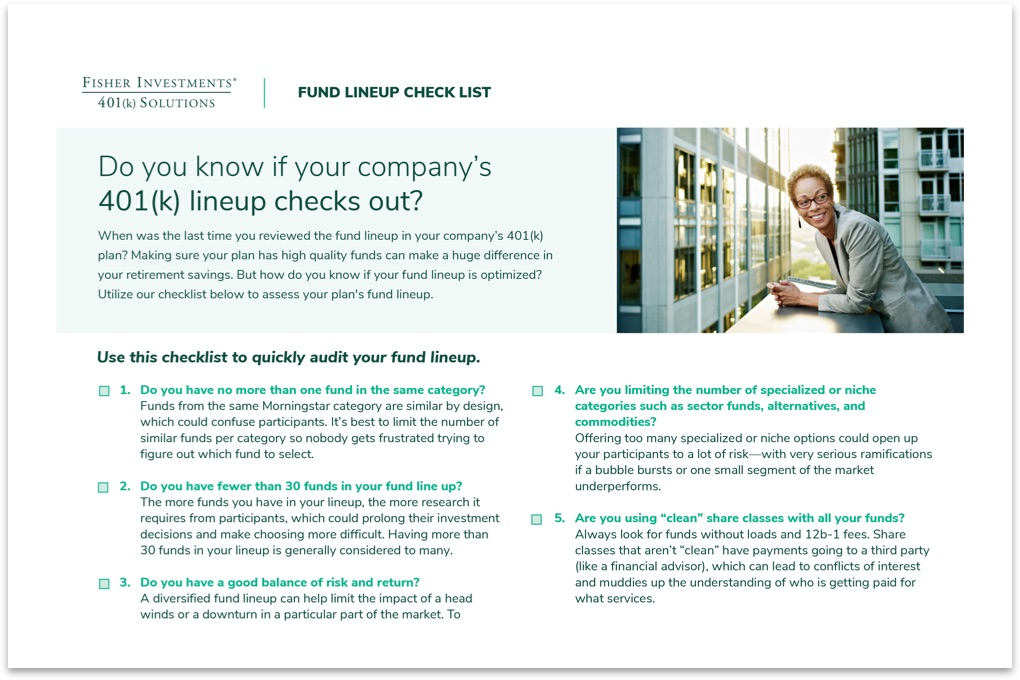

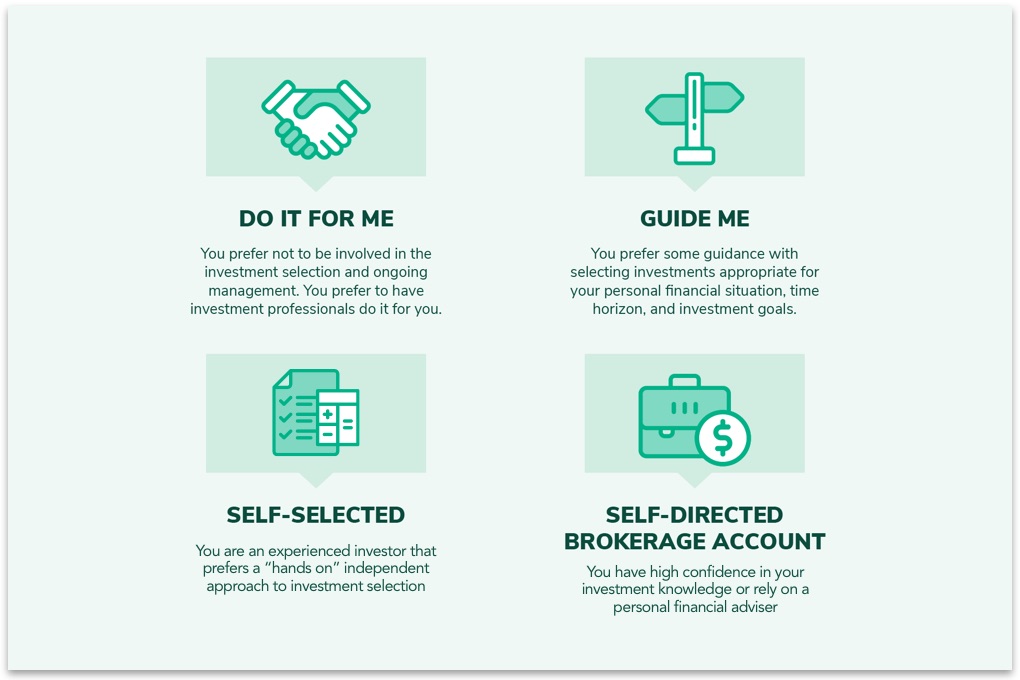

Superior Plan & Investment Guidance

Fisher provides flexible investment solutions, superior fund lineup management, and ongoing investment guidance to maximize wealth creation.

Simplified Plan Administration

We streamline retirement plan administration and payroll processes and provide a dedicated-point-of-contact for all plan servicing, troubleshooting and vendor management.

Unparalleled Service

We offer services other providers can’t or won’t provide. With Fisher you’ll receive tailored participant education programs along with one-on-one meetings to increase employee participation and improve retirement readiness.

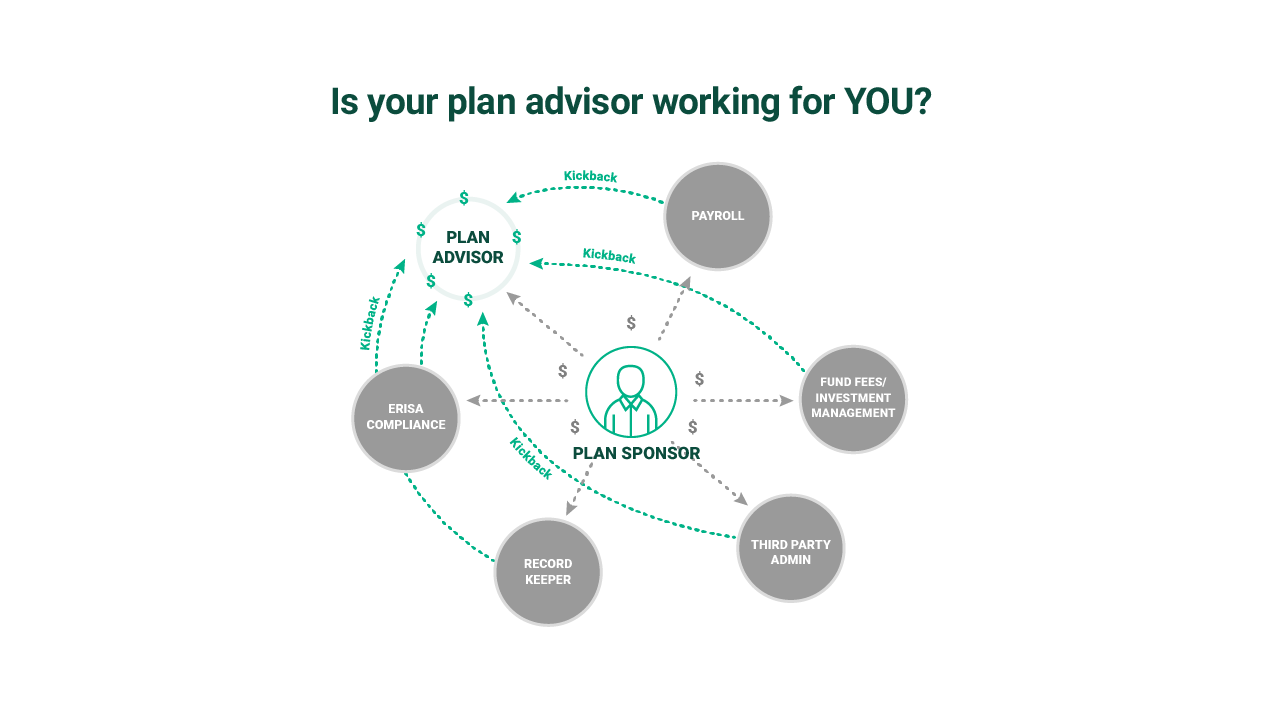

Legal Protection

As an ERISA 3(38) Investment Manager, Fisher takes full legal responsibility for selecting, monitoring, and updating the funds in your plan. This protects you and other plan sponsors from investment-related legal risk.