What is Employer Matching?

Employer match is a common 401(k) feature that enables the employer to contribute to an employee's retirement.

How it works

There are three common types of employer match: dollar-for-dollar, stretch and dollar amount.

Why offer it

It incentivizes employees to save for retirement and helps employers create a competitive benefits package.

How Fisher can help

There are many options when it comes to employer matching programs. Fisher helps business owners tailor their matching strategy to their individual needs.

There are four primary ways to implement a 401(k) employer match:

Dollar for Dollar Match

An employer will match employee contributions dollar-for-dollar up to a certain percentage of the employee's total compensation. For example, a 100% match of up to 3% of an employee's compensation.

Stretch Match

An employer matches 50% of employee contributions up to a certain percentage of the employee's total compensation. For example, 50% match up to 8% of an employee's compensation, for a total match of 4% of the employee's salary.

Dollar Amount Match

An employer matches a set dollar amount to each employee. For example, an employer matches the first $5,000 of an employee's contribution to the plan.

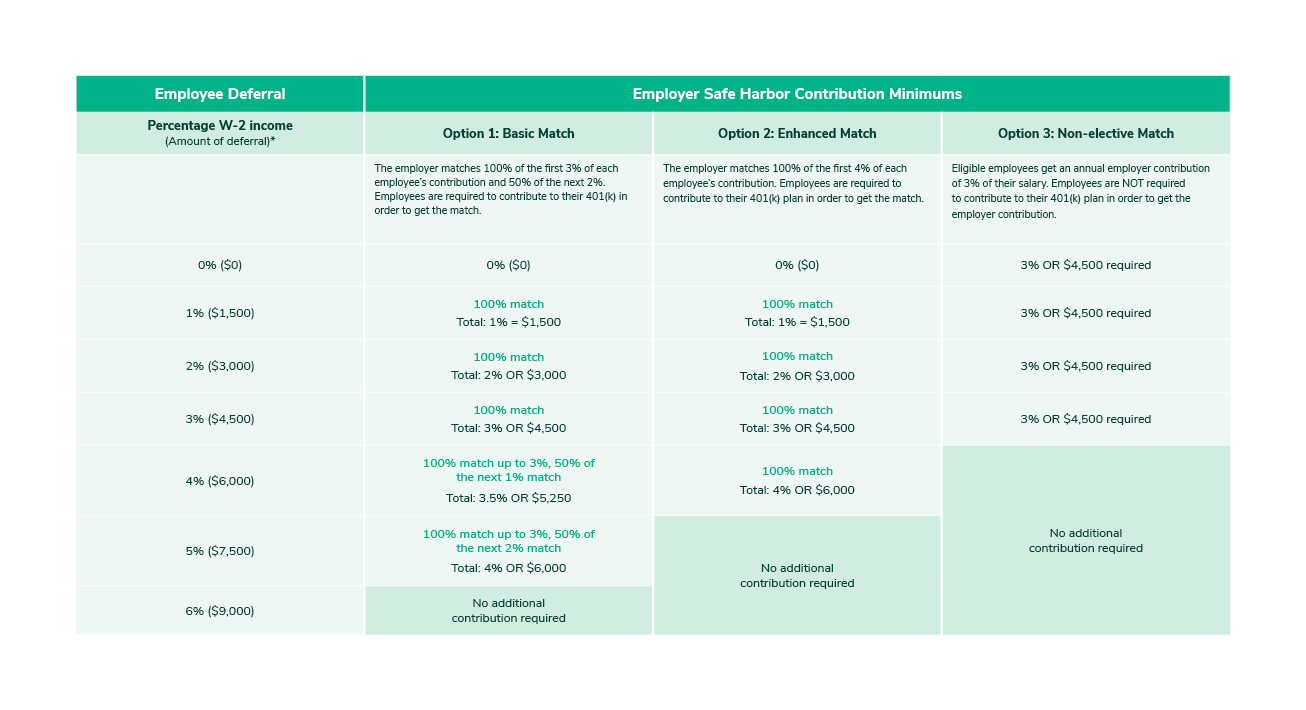

Safe Harbor Match

An employer uses one of three Safe Harbor strategies to automatically pass compliance testing: a non-elective contribution, a basic Safe Harbor match, and an enhanced Safe Harbor match. Click here for more details.

-

Compliance Testing

-

Corrective Distributions

-

Safe Harbor Plans

-

Eligibility and Vesting Schedules