A Well-Built Retirement Plan

There are many ways to tailor a retirement plan to meet your organization's unique business needs.

-

Add-On Plans

-

Roth Contributions

-

Employer Contributions

-

Plan Parameters

Add-On Plans

Employers can add supplement plans—like cash balance, ESOP, nonqualified deferred compensation (NQDC) and more—to help employees save even more for retirement and to increase business tax advantages.

Learn More

Employer Insights

Explore Your Priorities

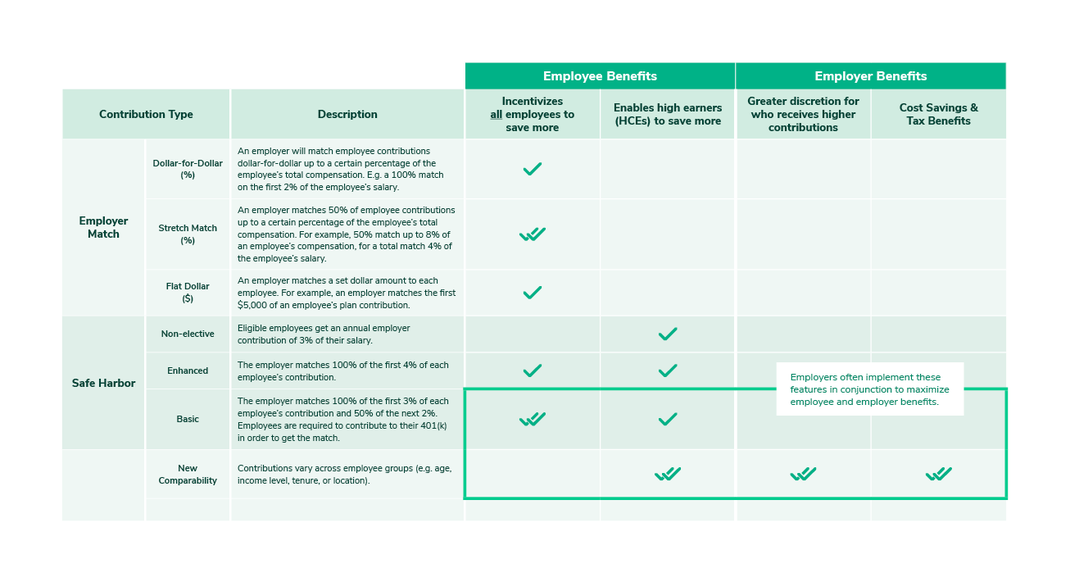

401(k) Employer Match Contributions Matter

Sometimes people need a little nudge. Matching can encourage employees to save more for retirement. Learn more about employer matching options.

Safe Harbor Frequently Asked Questions

Learn how safe harbor contributions can make compliance testing go more smoothly while increasing the retirement savings of both owners and employees.

Create a Compelling Profit Sharing Plan

Learn how to tailor a profit sharing plan that's flexible and provides owners and employees with another tax-advantaged way to save for retirement.