Building a Better Retirement Plan Starts Here

Building a better retirement plan starts with selecting the right advisor. Fisher 401(k) specializes in optimizing retirement plans to meet your company's unique needs, ultimately setting your employees up to retire comfortably.

Testimonials are representative of client views at the time collected. Clients are not compensated financially or otherwise for testimonials.

Must-watch 2-minute video

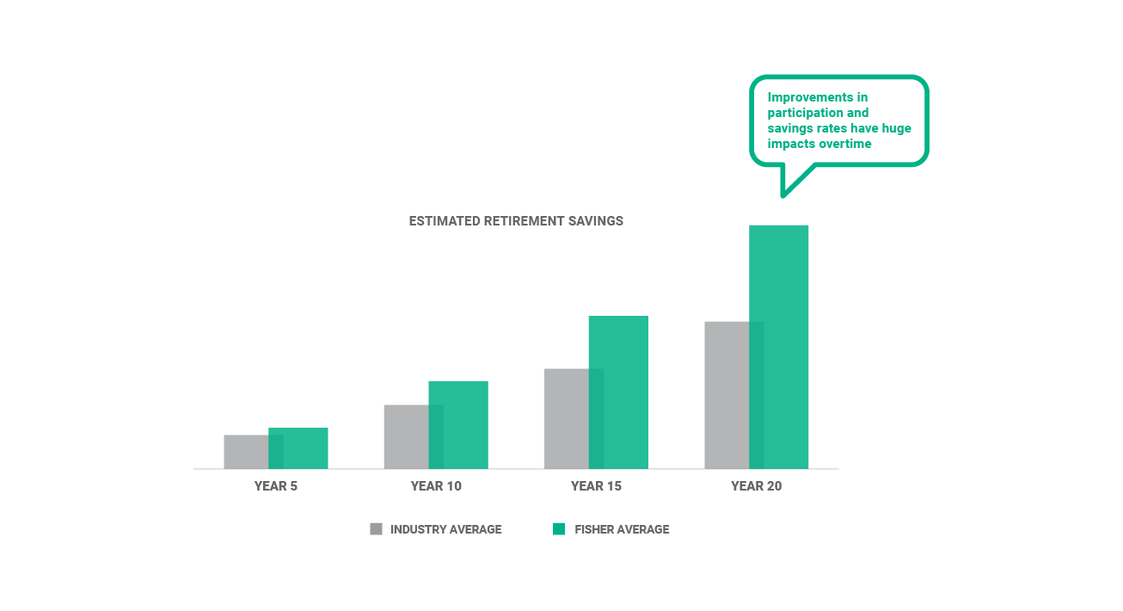

Measurably Better Outcomes

The results speak for themselves, Fisher clients have better performing plans that help employees get on track to retire comfortably. Watch this short 2 minute video to learn more.

Money Better Spent

Our advisory model maximizes for value generation, so less of your fee goes to non-wealth-generating services.

Get Your Free Fee Analysis

Wealth-Generating Fees

Adviser | Wealth-Generating

Fisher never accepts commissions, always putting your interests first. Some plans pay 3x more on fund fees because many brokers/advisors select funds that pay higher commissions.

Non-Wealth-Generating Fees

| Industry Average | Fisher Average | |

|---|---|---|

| Total Fee Percentage | 1.49%Information supported by footnote 4 | 1.40%Information supported by footnote 4 |

| Wealth Generating | 57% | 76% |

| Non-Wealth-Generating | 43% | 24% |

| Legend | Green color: Wealth GeneratingInformation supported by footnote 5 | Blue color: Non-Wealth-Generating |

1 Average increase in employee participation rates as of 12/31/21

2 Average increase in employee contribution rates as of 12/31/21

3 The fund fees calculation is based on data gathered for 500+ retirement plans considering hiring Fisher between January 2022 and June 2022. Improvement is measured by taking the mean of the actual fees paid by the prospect to fund investment managers for their existing fund lineup and comparing it to the mean of the estimated fund fees of the Fisher proposed fund lineup.

4 Industry Average data is based on Fiduciary Benchmarks, Inc Plan Profile Report for a $2mil 401(k) plan with 50 participants as of 12/31/20, The Industry Average fund fee (.48%) was calculated by taking 32% of the industry average total plan fees (1.49%), as this is the average proportion of the fee allocated to investment managers in the report. The Fisher Average fee (1.40%) represents the fees an average Fisher Investments 401(k) client would pay as of 12/31/20, based on a $2mil 401(k) plan with 50 participants; Ascensus for bundled recordkeeping (.33%); and the weighted average fund expense ratio based on actual client investment allocations (.07%).

5 Wealth-generating fees are defined as plan advisor fees & fund fees; non-wealth generating fees are defined as all other fees, including recordkeeper and third party administrator fees.