What is a 403(b) Plan?

A 403(b) plan is a type of retirement plan for the employees of certain non-profit organizations like schools, hospitals, charities, and churches. Click here for more details on the types of tax-exempt organizations who can offer a 403(b) plans.

How it Works

Similar to a 401(k) plan, a 403(b) plan allows employees to save a percentage of their salary, tax-deferred, and invest that money for retirement.

How a 403(b) is Different

A 403(b) is different than a 401(k) in some ways, including investment options, and some administration processes.

How Fisher Can Help

Fisher is one of America's top advisory firms with deep experience helping non-profit navigate evaluating and setting up a 403(b) tailored to their objectives.

MUST-SEE 2-MINUTE VIDEO

Is Your 403(b) Costing Your Employees Big?

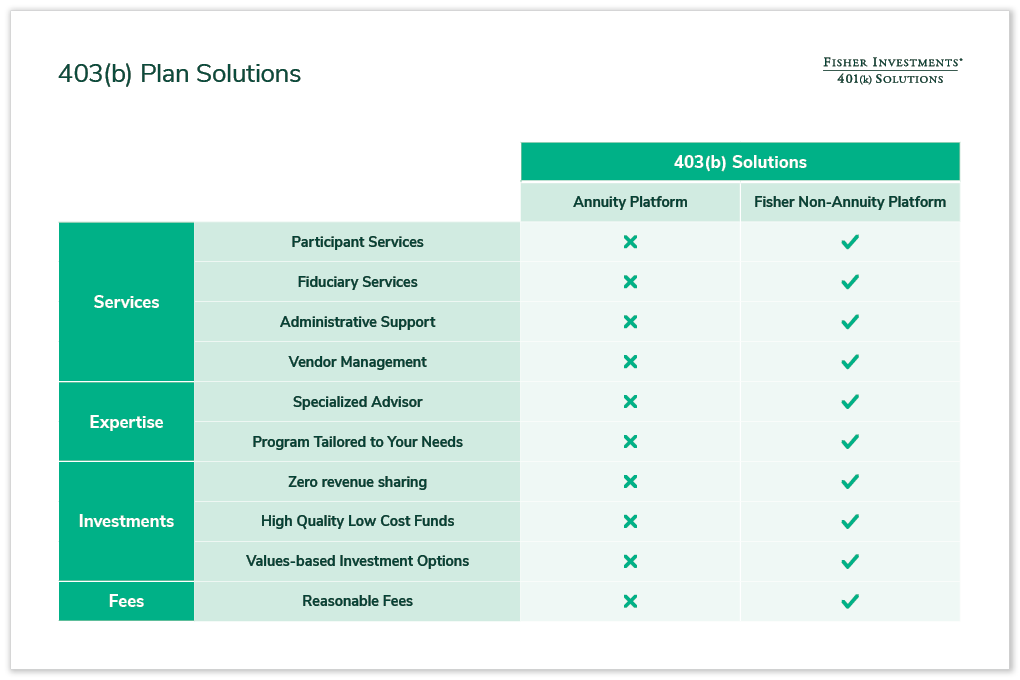

Watch this short video from a non-profit plan retirement specialist to learn more about the difference between non-annuity and annuity 403(b) plans.

Superior Plan & Investment Guidance

Fisher provides flexible investment solutions, superior fund lineup management, and ongoing investment guidance to maximize wealth creation.

Simplified Plan Administration

We streamline retirement plan administration and payroll processes and provide a dedicated-point-of-contact for all plan servicing, troubleshooting and vendor management.

Unparalleled Service

We offer services other providers can’t or won’t provide. With Fisher you’ll receive tailored participant education programs along with one-on-one meetings to increase employee participation and improve retirement readiness.

Legal Protection

As an ERISA 3(38) Investment Manager, Fisher takes full legal responsibility for selecting, monitoring, and updating the funds in your plan. This protects you and other plan sponsors from investment-related legal risk.