What is a Roth 401(k)?

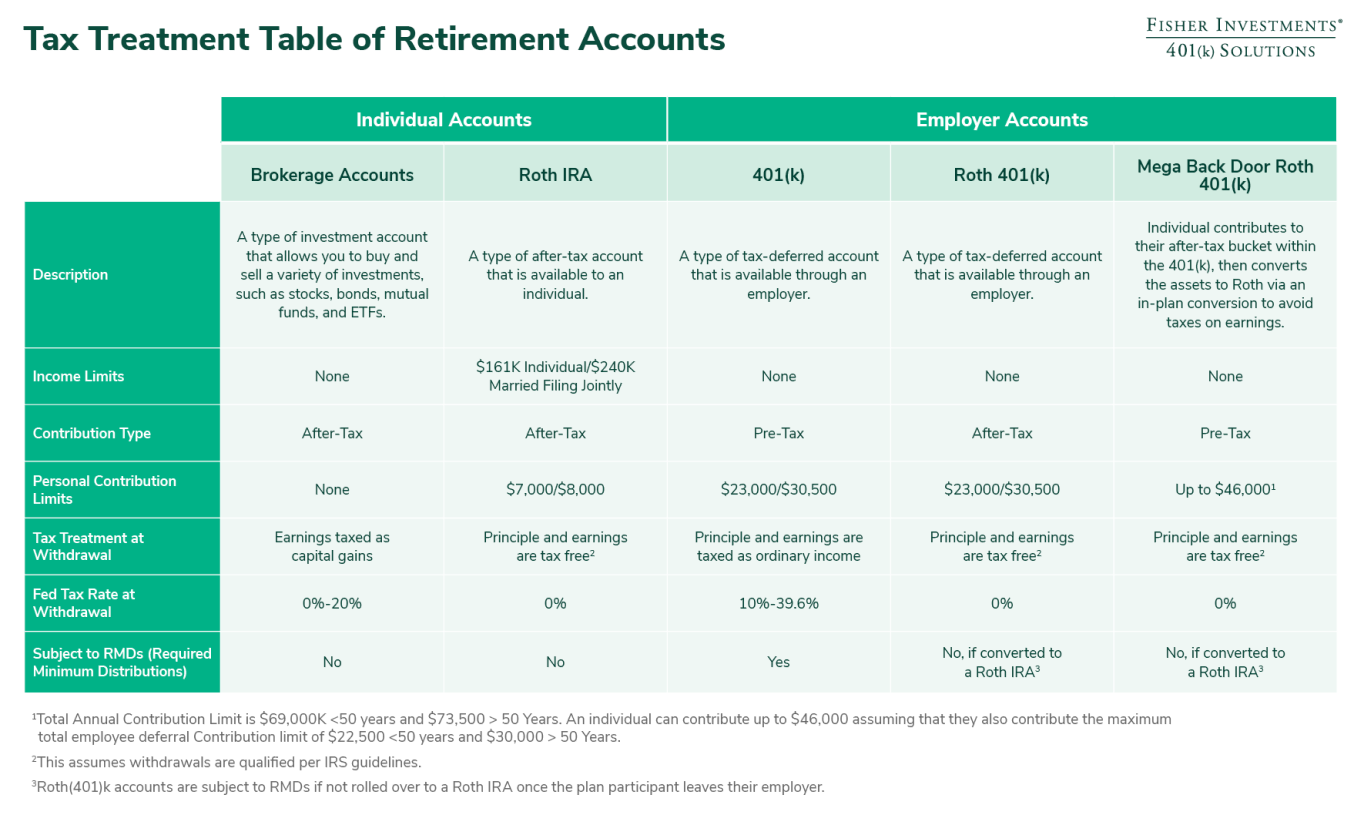

A Roth option for your 401(k) plan allows you and your employees to contribute after-tax earnings toward retirement–and face no additional taxes on those savings or any investment earnings when the money is withdrawn during retirement.

How it Works

A Roth 401(k) allows participants to contribute to different types of accounts with different tax benefits; a tax-deferred 401(k) and an after-tax Roth account.

Why Offer a Roth 401(k)

Enabling participants to contribute to tax-deferred and after-tax accounts can reduce overall taxes paid over the life of the investment and increase retirement savings.

Why Work With Fisher?

Fisher redefines what it means to be a partner in retirement by providing superior guidance, unparalleled service and simple and easy program administration.

Contact Us

Your Interests First

Incentive structures that are aligned with your success. No revenue sharing, no kick-backs or commissions. When you do better, we do better.

DIFY (Do It For You) Approach

Our servicing solutions focus on doing everything we can for you. From acting as a single point-of-contact for your plan to selecting your investments, we provide services that many other advisors can’t or won’t provide.

Superior Financial Guidance

As one of America’s top financial advisers, we work with you to build the optimal program and provide ongoing one-on-one financial guidance to maximize wealth generation.

Small Business Expertise

We specialize in small business retirement plans. As a result, we act as your advocate and have the knowledge, resources and clout to champion your needs.