Personal Wealth Management /

Iran-US Tensions Ratchet Up: Investment Implications

Regional conflicts don’t disrupt markets for long.

After US drone strikes at a Baghdad airport Friday killed the general in charge of Iran’s elite forces, speculation is swirling over whether the situation will escalate. In response, early Wednesday local time, Iran launched missile strikes on US bases in Iraq. There were no reported casualties, which some believe was intentional on Iran’s part and opens the door to a climbdown in tensions. However, that is unknowable. Concern is palpable, which is understandable given the potential destruction and loss of life. But there is also significant speculation about what potential escalation may mean for stocks—with some fearing negative fallout. Yet markets are no stranger to geopolitical risks. For investors, knowing how markets typically respond to such events is critical for investment decision making.

This incident is the latest in escalating tensions between Iran-backed militia groups and the US military. American officials blame Iran for an assault on the US embassy in Baghdad on December 31 and New Year’s Day, which Iran-backed groups say was a response to American airstrikes on militia groups. The US alleges its strike that killed Qassem Soleimani, the Iranian commander who allegedly orchestrated proxy conflicts across the Middle East, was to preempt further attacks. Yet many worry this will do the opposite, potentially spurring outright war between the US and Iran. Both sides have issued a variety of threats to military targets. America has threatened to ratchet sanctions up further. Iran claims it could block the Strait of Hormuz, a major chokepoint for shipping from the oil-rich Persian Gulf.

US tensions with Iran aren’t new or terribly surprising, especially following the US’s withdrawal from the Iran nuclear deal last year and imposition of strict economic sanctions. Iran and its proxies have been heavily involved in Iraq and the rest of the Middle East for some time as well. There is also precedent for Iran’s threats to block oil supplies. Last May and June, Iran allegedly attacked oil tankers in the Strait of Hormuz. It actively seized some during the summer. But the effect on oil prices was brief, which seems pretty rational to us. During 1980s’ Iran-Iraq war, when combatants sought to sink each other’s tankers, they stopped only 2% of oil traffic. As for other means of blocking supply, in September, Iran-backed militants used drone attacks to shut down 50% of Saudi Arabian production—a direct attack against oil infrastructure. But facilities were back online within days. Despite major disruptions—and apocalyptic press coverage—volatility was fleeting; oil markets returned rapidly to normal.

To help assess probable stock market outcomes from the latest incident, there is unfortunately a long history of regional conflicts—and market reactions to them. Conflict in the Middle East, North Africa and Central Asia has been near constant for decades. Israel has dealt with unfriendly neighbors since its post-WWII inception—a perpetual flashpoint. The Iran-Iraq War lasted through most of the 1980s, involved chemical weapons and attacks on hundreds of oil tankers. Just within the past decade, Libya’s 2011 civil war took a significant chunk of oil production off the global market. In 2013, some thought Egypt’s coup would endanger critical trade routes through the Suez Canal (as in 1952’s coup and attempts to retake it in 1956). The ongoing Syrian civil war has at times threatened to spiral into a full-fledged proxy war between Russia and the US. Syria is far from the only US involvement in the region. Other incidents include 1953’s US-backed Iranian coup and the early 1990s’ Persian Gulf War, as well as the 2003 – 2011 Iraq War and America’s longest military operation: the War in Afghanistan, which has persisted since 2001.

Some of these incidents coincide with bear markets. But most of them don’t, suggesting bigger factors like global economic growth overwhelm regional incidents. Uncertainty leading up to regional conflict can weigh on returns, but it is usually short-lived. Counterintuitively, the outbreak of armed conflict eases uncertainty over whether tensions will erupt, which can help stocks begin moving on. Markets can then weigh the conflict’s scope—how much of the global economy it is actually affecting and the likelihood it impacts corporate profits. As investors realize the conflict is too small to disrupt global commerce, stocks usually move on, as they have for decades following regional conflicts in the Middle East and elsewhere. Markets are callous.

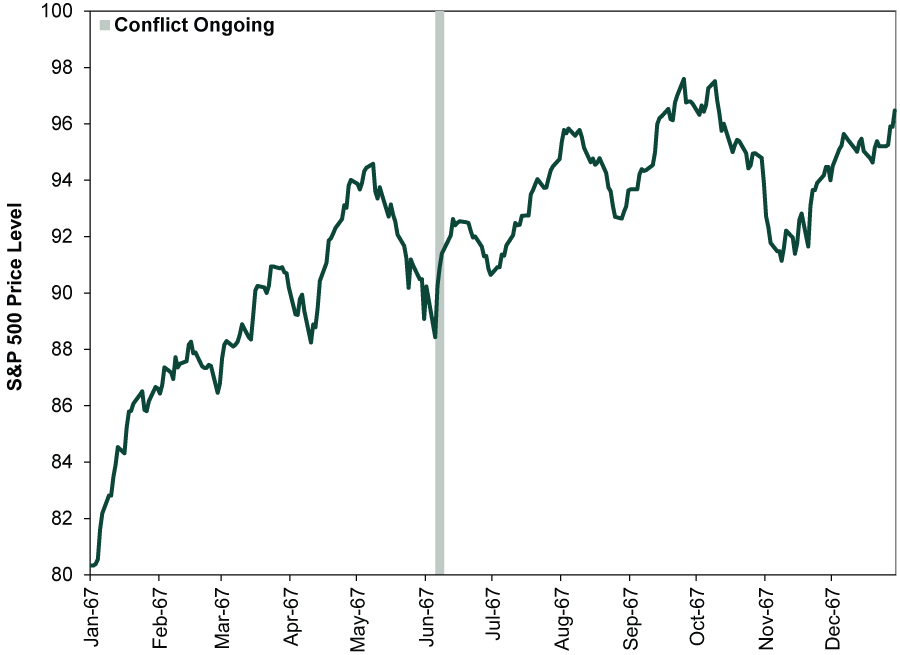

Exhibit 1: Six-Day War

Source: FactSet, as of 1/8/2020. S&P 500 Price Index, 12/31/1966 – 12/31/1967.

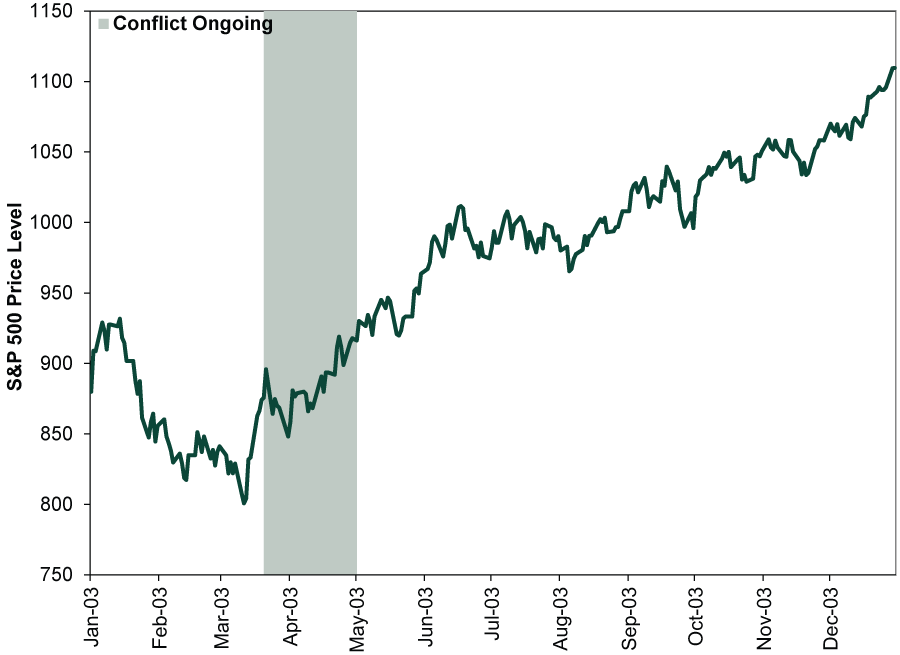

Exhibit 2: Iraq Invasion

Source: FactSet, as of 1/8/2020. S&P 500 Price Index, 12/31/2002 – 12/31/2003.

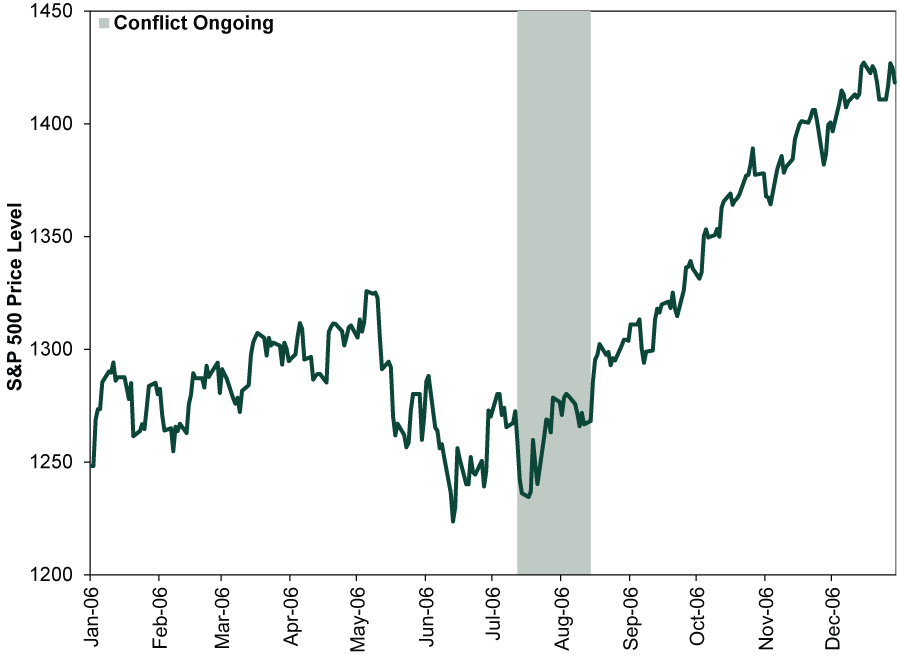

Exhibit 3: Israel-Hezbollah Conflict

Source: FactSet, as of 1/8/2020. S&P 500 Price Index, 12/31/2005 – 12/31/2006.

For conflict to have a lasting, material effect on global markets, it generally must escalate to full-scale war covering vast swaths of the global economy. Think: WWII. When conflict started to break out in Europe, stocks appeared to be rebounding from 1937’s bear market. But when the Nazis invaded Czechoslovakia’s Sudetenland in October 1938, making Hitler’s greater territorial ambitions undeniable, it forced stocks to reckon with the mounting likelihood of severe conflict across the Continent. By the time France fell, stocks were back in the throes of a bear market that wouldn’t end until 1942. Markets had to contend with the growing prospect of war destroying millions of lives, massive amounts of property and years’ worth of global economic output.

For investors, the question to consider, in our view, is whether a regional conflict will spill over to something much bigger and broader. The current saber-rattling could affect sentiment, and possibly bring a correction (sharp, sentiment-driven decline of around -10% to -20%). But a correction isn’t a bear market, and one can happen for any or no reason. Trying to time them is folly. So, investors should ask themselves how likely current tensions are to spiral into world-spanning war, ending global economic growth.

The other major concern regarding potential escalation in the Persian Gulf is over oil prices, which have swung wildly in the wake of the attack. Any disruption in Middle East supplies could send prices higher, but a sustained march upward doesn’t seem likely given ready access to abundant reserves if needed. If the recent strike on Saudi Arabia’s oil facilities couldn’t knock energy markets, nor 1980s’ rampant Persian Gulf tanker attacks, then presuming something similar now carries a much greater impact seems mighty speculative. Meanwhile, the Middle East’s oil market share over the last couple decades has substantially diminished, accounting for only around a third of global oil production currently. America is now the world’s biggest oil producer, overtaking Saudi Arabia and Russia last year, and is ramping up petroleum exports to the rest of the world—a big counterweight to Persian Gulf production. American exports of oil and oil products are closing in on 9 million barrels a day—about half what the Persian Gulf exports and up from less than a million 15 years ago.

Even if oil rises and stays elevated, this isn’t the 1970s. The US economy is much less energy-intensive than it was then. Adjusted for inflation, every thousand tons of oil used today produces $23.8 million in GDP. In 1990, it was only $13.7 million.[i] Skyrocketing oil prices might hurt some, but overall it would likely be a pin prick. One estimate puts the impact of escalating conflict with Iran at 0.3% of global GDP. Then, too, higher oil prices would also be a boon to US shale producers who have been struggling financially. More output from them would, eventually, rein prices back in. Markets tend to be self-correcting that way.

[i] “Why Oil Price Swings Won’t Burn America’s Economy or Your 401(k),” Ken Fisher, USA Today, 8/25/2019. https://www.usatoday.com/story/money/columnist/2019/08/25/dow-iran-threatens-oil-supply-but-it-wont-derail-bull-market/2060318001/

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

You Imagine Your Future. We Help You Get There.

Are you ready to start your journey to a better financial future?

Where Might the Market Go Next?

Confidently tackle the market’s ups and downs with independent research and analysis that tells you where we think stocks are headed—and why.