Personal Wealth Management / Economics

The UK’s May Flowers

The UK’s first batch of April economic data revealed some bright spots.

Did winter showers start bringing some springtime flowers for the UK economy? (Photo by aleroy4/iStock by Getty Images.)

What is this about a wedding we hear? Possibly boosted by preparations for the Duke and Duchess of Sussex’s nuptials,[i] UK April retail sales snapped back after the dreary winter, helping bring some much needed economic cheer to the land. Adding to the good news, UK inflation fell to its lowest rate in 13 months in April. Both figures are backward-looking and not predictive for stocks, but better than expected results—and lots of flowers—might help ease some of the recent economic uncertainty, perhaps helping lift investors’ spirits.

Over the past few months, middling economic data and stock market volatility caused investor sentiment toward Britain to darken. Q1 GDP probably didn’t help as growth slowed to its weakest since 2012. Even though the “Beast from the East,” which dumped snow across the Isles, bore much of the blame, folks worried there was more at work than weather. Purchasing managers’ indexes (PMIs) for April showed growth, with forward-looking new orders indexes suggesting further expansion ahead, but the raw readings weren’t as strong as analysts expected. Manufacturing slowed, while services sped only modestly.

This brings us to yesterday’s retail sales report, which showed shoppers buying 1.6% more by volume (quantity purchased) in April than March, “smashing expectations” and reversing March’s -1.1% m/m decline. By value (amount spent), April retail sales also rose 1.6% m/m, rebounding from -0.9% in March. Moreover, sales growth was broad based, with all sectors save department stores rising. Even there, as the UK’s Office for National Statistics (ONS) noted, “Department stores declined following relatively strong sales last month, when their online sales were boosted during the adverse weather.” Some coverage noted the 4.7% rise in automotive fuel sales, worrying high gas prices would dent sales elsewhere—but excluding gasoline, retail sales still rose 1.3%, countering that narrative. Now, we wouldn’t get too excited over one month’s data. Plus, retail sales are just a small slice of UK households’ consumer spending—services comprise the bulk. But it does help argue against the prevailing storyline growth is peaking and the UK economy flailing. Growth rates might cool a bit once the frenzy for Royal Wedding tchotchkes fades from the data and recreational bakers have had their fun working with elderflower cordial, but with credit markets looking healthy and incomes on the rise, we see no reason demand should falter materially.

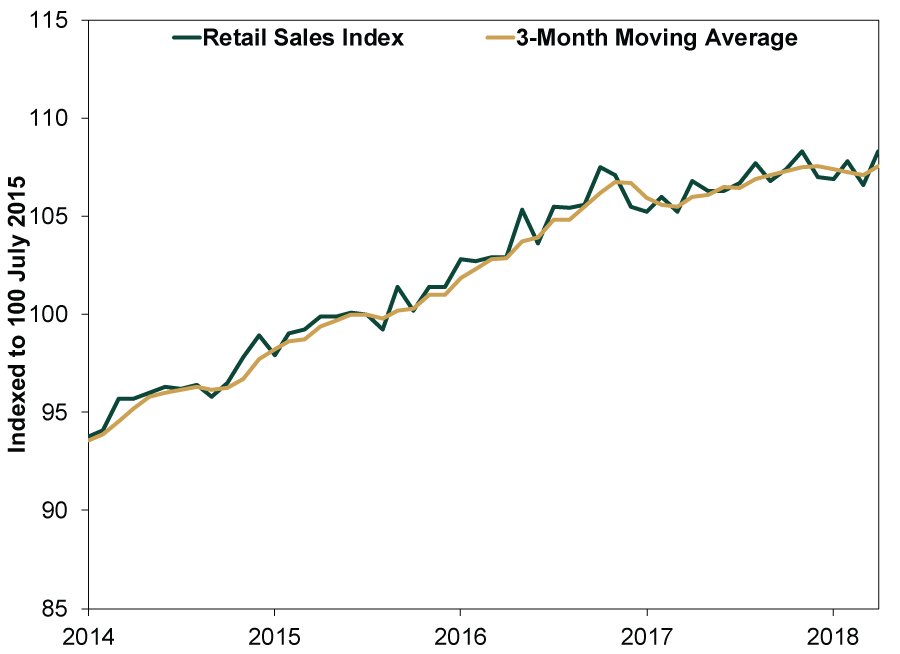

Exhibit 1: UK Retail Sales Spiky but Up

Source: Office for National Statistics, as of 5/24/2018. All retailing including automotive fuel, seasonally adjusted chained volumes, January 2014 – April 2018.

Real (inflation-adjusted) incomes should get a further boost from slowing inflation. When the consumer price index (CPI) crossed over 3% late last year, households felt squeezed and fretted over dwindling purchasing power and potential rate hikes. But after peaking last November at 3.1%, inflation has slowed. April’s CPI rose 2.4% y/y, its slowest increase since March 2017. Some may breathe a sigh of relief—and take a vacation as lower airfares led the decline[ii]—but even when inflation was higher it didn’t stop consumer spending or broader economic growth. While rising inflation was never very threatening to the UK’s economic expansion or bull market, in our view, it did impact sentiment. Now that it is fading a bit, investors should be able to focus more on the UK’s positive fundamentals.

Exhibit 2: Inflation Is Calming

Source: Office for National Statistics, as of 5/24/2018. Consumer Price Index All Items and CPI excluding Energy, Food, Alcohol & Tobacco, January 2014 – April 2018.

On Friday, the ONS released its second estimate of Q1 UK GDP, confirming its earlier estimate of 0.1% q/q (0.4% annualized) growth. The ONS talked down the weather’s impact, noting the rise in energy production offset some weather-related declines in construction and shopping—but under the hood there were some bright spots. Consumer spending rose 0.2% q/q (1.0% annualized), slowing only slightly from Q4 2017. Business investment slipped -0.2% q/q, but the declines were concentrated in transport equipment (-3.7% q/q)—long a volatile category—and structures (-0.6% q/q). Investment in heavy machinery and plant equipment jumped 3.0% q/q, and intangible fixed assets—including software and research & development—rose 1.4% q/q, its fourth straight positive quarter. Overall, it seems hard to argue businesses are universally retrenching.

Looking ahead, we see reasons for optimism. The yield curve remains positively sloped, supporting bank lending and money supply growth. Both remain solid, indicating capital is flowing to households and businesses—another sign reality is better than many media portrayals suggest. The UK economy may not lead the developed world, but as it hums along, continued growth should reveal a resilient reality, perhaps buoying sentiment long after wedding mania fades from the headlines.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments has developed several informational and educational guides tackling a variety of investing topics.