Personal Wealth Management / Market Analysis

About That ‘Brexit’ Pounding

Making sense of doom-and-gloom Brexit warnings.

What happens if these two break up? Photo by Toby Melville - Pool/Getty Images.

Stop me if you've heard this one before: If the UK leaves the EU, the pound will plunge, interest rates will soar and the economy will crater, because foreign investors will stop funding the current account deficit. Financial Armageddon will ensue, and probably a plague on humanity. Or something-I might have exaggerated for dramatic effect.[i] BoE Governor Mark Carney and others have warned of this dismal chain reaction, and the sirens got louder after the first draft of Britain's renegotiated EU membership landed with a resounding thud, giving Brexit advocates more momentum. But it is far too early to fear the worst, and not just because the vote could easily go either way. These warnings are dubious on their face and frankly misunderstand how capital markets work.

The current account deficit is one of the most widely misperceived economic statistics. You've probably heard a deficit means a country consumes more than it makes, sending wealth abroad in exchange for foreign goods, and-as Carney put it-depending on the "kindness of strangers" (a bizarre euphemism for profit-seeking foreign investors) for investment. This could hardly be further from the truth. Economies aren't fixed pies. They grow and create wealth. The UK is quite good at creating wealth, and importing more than it exports doesn't shrink the economy. That wealth creation prowess makes investors everywhere eager to put their money to work there.

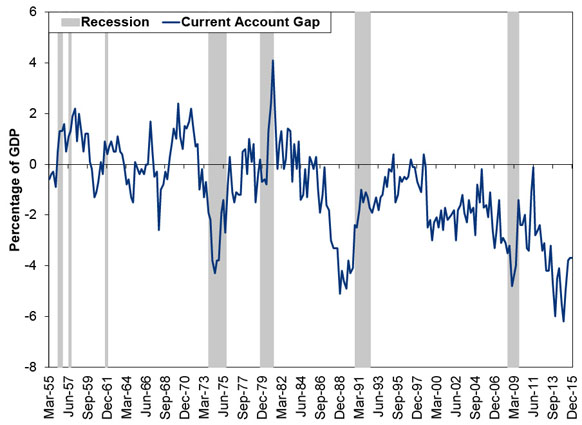

Don't take my word for it, though. Here is a picture of the UK's current account gap (as a percentage of GDP) and UK recessions since 1955. It shows current account surpluses in good and dreary economic times alike. Ditto for current account deficits. If anything, since a current account deficit became a near-constant presence, growth rates have become far less volatile-an interesting point to the many who try to argue economies driven by services, not manufacturing and exports, are inherently inferior.

Exhibit 1: The UK's Current Account and Recessions

Source: FactSet, as of 2/4/2016. Current account balance as a percentage of GDP and UK recessions, Q1 1955 - Q3 2015. Recession dating from UK Office for National Statistics, based on quarterly GDP at factor cost.

The current account doesn't impact deficit financing, either. As Exhibit 2 shows, gilt yields have plunged alongside a current account deficit. Kind strangers aren't taking pity on Her Majesty's Treasury. They're investing in one of the world's most stable, trusted capital markets and willing to accept an ever-lower premium to do so, because default risk is minimal. Bonds, like all markets, move on supply and demand. Supply is a function of Treasury issuance and central bank purchases. Demand is influenced by interest rate differentials, inflation expectations, bank capital requirements and creditworthiness (among others), none of which are connected to the current account.

Exhibit 2: Current Account and Gilt Yields

Source: FactSet and Global Financial Data, as of 2/4/2016. Current account balance as a percentage of GDP and 10-year gilt yields, January 1958 - October 2015.

Nor is there any visible or logical relationship between the current account and pound. Or between pound strength/weakness and the UK economy. Currency moves aren't cyclical, and they have no set economic impact.[ii]

Exhibit 3: Current Account and USD/GBP Exchange Rate

Source: FactSet, as of 2/4/2016. Current account balance as a percentage of GDP and USD/GBP exchange rate, Q1 1957 - Q3 2015. USD/GBP rate used in lieu of a trade-weighted currency basket due to its longer data set.

As a general rule of thumb, if your current account is negative, your capital account is positive-and when your current account is positive, your capital account is negative. They cancel each other out. When country X is a net exporter to country Y, country X is also a net foreign investor in country Y. I won't belabor the details here, not when Investopedia does it so well, but it is simple math and is generally removed from how competitive a country's economy is.

So forget the current account. It doesn't matter. What does matter are these simple questions:

- Will the UK automatically become a riskier, iffier place to invest if it leaves the EU?

- How would leaving the EU impact the UK's foreign trade relationships?

Question 1 seems fairly easy. At the risk of oversimplifying, inside the EU, the UK has free markets, the rule of law, stable and strong property rights, amazing human capital, successful businesses big and small, nascent technology hubs, abundant petroleum resources, a dynamite service sector and a fantastic entrepreneurial spirit. Outside the EU, the UK would have ... free markets, the rule of law, stable and strong property rights, amazing human capital, successful businesses big and small, nascent technology hubs, abundant petroleum resources, a dynamite service sector and a fantastic entrepreneurial spirit. Inside the EU, the UK is occasionally subject to some odd regulations, courtesy of Brussels bureaucrats. Outside the EU, the UK would be occasionally subject to some odd regulations, courtesy of London bureaucrats, but at least free of the EU's bizarre antipathy toward actual competition.[iii] Inside the EU, the UK has some of the world's oldest, most trusted capital markets and a centuries-long history of growing and evolving. Outside the EU, the UK would have some of the world's oldest, most trusted capital markets and a centuries-long history of growing and evolving.

In many regards, one could make a strong case that Brexit wouldn't change much of what investors have long loved about the UK. But the wild card is trade. For all the EU's annoyances, regulations and overall institutional fecklessness[iv], the single market is one of the greatest creations in the history of international trade. Internally, it is tariff-free, with minimal administrative barriers, particularly in trade of physical goods.[v] The bloc also has free-trade agreements with non-EU European nations, Israel and most of the Mediterranean region, Korea, South Africa, huge chunks of Africa and Central America and, soon, Canada. A blockbuster deal with the US is in negotiations, albeit perilous and slow-moving ones.

Losing these free-trade arrangements would hurt. But it is far from certain to happen. If UK voters were to pick Brexit, the government could easily re-up these trade deals on a bilateral basis, using the broad terms of the EU's trade deals, with minimal hiccups. (Or they could botch it-there are no guarantees.) They could also negotiate to maintain free trade with the rest of the EU, something big European exporters like Germany no doubt want, lest they lose access to the UK's mighty consumers. And in the long run, trade could even get easier for the UK, which would be free to negotiate bilateral deals of its own choosing, instead of being at the eurocrats' mercy. The more countries participating in a trade deal, the longer negotiations run, and the more watered-down the eventual deal becomes. The Trans-Pacific Partnership (a free-trade bloc including the US, Japan, Canada, Australia and a few other nations on either side of the Pacific Ocean) took about a decade to negotiate, and it might never be ratified. The World Trade Organization's Doha round-negotiations aiming to lower trade barriers worldwide-are basically the Esperanto of trade talks. When only two or three countries need to agree to terms and ram a deal through the legislature, it's faster and easier.

But everything in that last paragraph is very wait-and-see-the sort of thing markets must discover and price in, if necessary, as the situation evolves. For the moment, it's premature and impossible to handicap. After all, EU treaties have no exit provision. If Britain votes to leave, the actual leaving could take a while to negotiate, and it will probably happen loudly and publicly. That could help keep negative surprise at bay.

Anyway that's all hypothetical and in the future, and probably not something for stocks to fuss over in the here and now. Markets move on probabilities, not possibilities. At some point, should Brexit become high-probability, markets will begin dealing with it and handicapping various outcomes, good or bad, as they slowly figure out whether leaving would be a net plus, minus or zero sum. But that time probably isn't here yet.

[i] But only slightly.

[ii] All else equal-ish, money tends to flow to the highest-yielding asset, but all else is never equal, which is why this point is consigned to a footnote.

[iii] Unless it joined the European Economic Area, like Norway, which would subject it to EU rules but remove all veto power, in exchange for access to the single market. That, as some have rightly pointed out, would be an odd step backward and really not consistent with the goals of Brexiting, so it is hard to imagine it actually happening. Politicians aren't always the brightest bulbs that ever burned, but still.

[iv] Yep, fecklessness. For all the talk of infringing on national sovereignty, EU institutions actually don't do much beyond point fingers and send angry letters. If they had real power, Hungary wouldn't have devolved into a proto-fascist state, and Poland's new government wouldn't have reduced media and judicial independence.

[v] Services trade is a work in progress.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments has developed several informational and educational guides tackling a variety of investing topics.