Personal Wealth Management / Market Analysis

Chart Fest 2013!

If a picture says 1,000 words, here are 44,000 bullish words.

In honor of Hammerin’ Hank Aaron, here are 44 visual reasons why this bull has room to run. Photo by Hulton Archive/Getty Images.

Well folks, September is here—and QE decision day is nigh. Will the Fed announce a taper? No taper? A symbolic taper? (A what?) Investors everywhere are itching to find out! After all, four and a half years into the bull, folks still fear stocks have little fundamental support. Even though data show otherwise, many assume the Fed’s easy money is the only thing propping up markets and the US economy. Once the punch bowl leaves, they fear, so will growth. What they don’t realize: We have a huge pile of evidence to the contrary. The UK’s QE program ended late last year. Since then, Britain’s yield curve has steepened, its economy has accelerated and stocks are up—a powerful precedent for the US! That’s one of many underappreciated positives at work today—and here are 44 charts to prove it.

Let’s start with the UK. Since QE ended, the BOE’s balance sheet has shrunk a bit—just what folks fear happening in the US. Yet the money supply (which shrunk during QE) has grown, the yield curve has steepened, and lending has improved.

Source: Bank of England, as of 9/5/2013.

And the economy has accelerated. PMI surveys—all choppy during QE—have jumped. Retail sales are up. Fixed investment rose consecutively for the first time since 2007. Home prices have accelerated.

Sources: Markit, Office for National Statistics, as of 9/5/2013.

That’s just the tip of the iceberg of today’s underappreciated positives. Here are 36 more!

US corporate profits are at all-time highs and rising—and stocks aren’t even close to matching profit growth during this bull market.

Source: St. Louis Federal Reserve, as of 8/30/2013.

Looking ahead, growth seems poised to continue. The Leading Economic Index is high and rising—usually, LEI falls for some time before a recession begins.

Source: Thomson Reuters, as of 8/30/2013.

The new orders subindexes of the ISM’s PMI surveys—the most forward-looking components—are accelerating. Export orders are rising, too, suggesting healthy demand abroad.

Source: St. Louis Federal Reserve, as of 9/5/2013. Above 50 indicates growth.

Total trade—exports plus imports—is at all-time highs and rising, even as falling petroleum imports weigh on headline results. Excluding petroleum, imports are well into record territory.

Source: Bureau of Economic Analysis, as of 8/30/2013.

Source: Bureau of Economic Analysis, as of 8/30/2013.

Falling petroleum imports aren’t a bad sign—we’re just making more at home, thanks to the shale boom.

Source: Energy Information Administration, as of 8/30/2013.

Worried about consumers? Retail sales are high and rising, too.

Source: St. Louis Federal Reserve, as of 8/30/13.

Government spending is still falling, but businesses are more than filling the shortfall.

Source: Bureau of Economic Analysis, as of 8/30/2013. Cumulative change in government and business investment since Q2 2009.

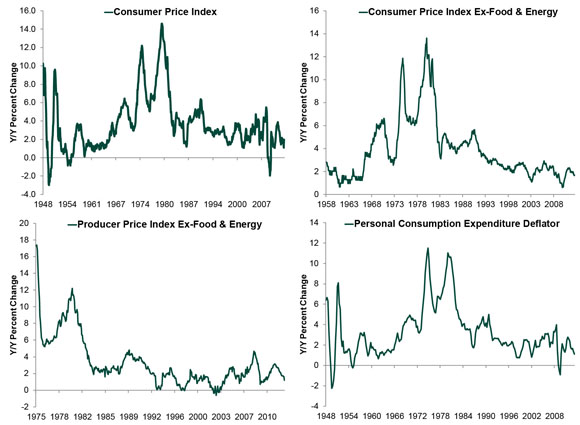

Any way you measure it, inflation is tame.

Source: St. Louis Federal Reserve, as of 9/4/2013.

And with capacity utilization still relatively low, inflation likely stays benign for some time.

Source: St. Louis Federal Reserve, as of 9/4/2013.

The rest of the world is in good shape, too! Passenger and freight air traffic is growing.

Source: IATA, as of 9/4/2013.

Goods are moving on land, too—North American intermodal rail shipments are up 3.5% over 2012 year to date and have accelerated for six weeks running.

Source: American Association of Railroads, as of 9/4/2013.

Record-high global trade is growing again.

Source: St. Louis Federal Reserve, as of 9/4/2013.

The eurozone is stabilizing. Manufacturing and services PMIs are growing again.

Source: Thomson Reuters, as of 8/30/2013. Above 50 indicates growth.

On balance, European LEIs are rising.

Source: The Conference Board, as of 9/4/2013.

Peripheral eurozone sovereign 10-year bond yields remain tame despite rising political uncertainty.

Source: Thomson Reuters, as of 6/30/2013.

Emerging Markets are slowing some, but they should still add to global growth. China, for example, is poised to grow more in dollar terms than during its years of double-digit growth.

Source: World Bank, as of 7/31/2013.

Korea is reaccelerating, too, thanks to rising exports—it seems the weak yen isn’t weighing on Asian exporters as feared.

Source: St. Louis Federal Reserve, as of 9/5/2013.

Risks exist—they always do. But today’s risks are either widely discussed or misinterpreted. For example, investors fear the impact of Syrian conflict, but history shows localized tensions have a fleeting impact on stocks.

Source: St. Louis Federal Reserve, Fisher Investments Research.

Stocks have hit new highs this year, but all-time highs aren’t necessarily peaks—the S&P 500 hit 345 new highs during the 1990s bull.

Source: Global Financial Data, accessed 8/9/2013.

Finally, by historical standards, stocks aren’t overvalued. The S&P 500 and MSCI World Index forward P/E ratios are in line with long-term averages—we still haven’t seen the multiple expansion typical of late-stage bull markets.

Source: Thomson Reuters, as of 7/9/2013.

And if that’s not enough, there are 62.5 reasons to be bullish here. (Sorry, no charts.)

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments has developed several informational and educational guides tackling a variety of investing topics.