Personal Wealth Management / Market Analysis

Charts of the Day: PPI Doesn’t Lead CPI

Usually, they move together.

Is inflation about to get a lot worse? The general consensus today is a big fat “yes,” following the news that the Producer Price Index (PPI)—a measure of businesses’ costs—jumped 1.0% m/m in January (9.7% y/y).[i] Conventional wisdom holds that rising producer prices eventually bleed into consumer prices, making PPI a leading indicator for the Consumer Price Index (CPI). Hence, PPI surges often grab eyeballs. That seemingly went double today, probably because of how politicized inflation has become—and how weary we all are of paying more at the grocery store and the pump. So please take a deep breath and understand that when we set the record straight on PPI’s inflation-predicting powers—which we will do momentarily—it isn’t a political or ideological statement or an attempt to dismiss the pain inflation has caused so many. Rather, ours is a market-oriented lens: We think seeing PPI correctly can help you put inflation talk in context, reducing the likelihood of a reactionary investment decision.

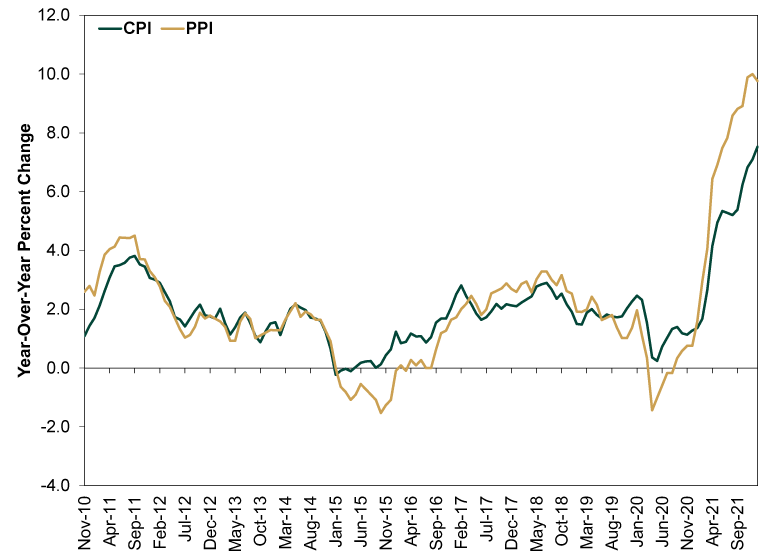

The PPI leads CPI argument sounds intuitive enough. There is even an entire economic theory, known as “cost-push inflation,” that stems from it. Problem is, the data don’t back it up. Exhibit 1 shows PPI and CPI since the modern headline PPI was born in late-2010. As you will see, they move in lockstep. One doesn’t lead the other.

Exhibit 1: CPI and PPI March Hand in Hand

Source: St. Louis Federal Reserve, as of 2/15/2022. Consumer Price Index (All Items, US City Average) and Producer Price Index: Final Demand, November 2010 – January 2022.

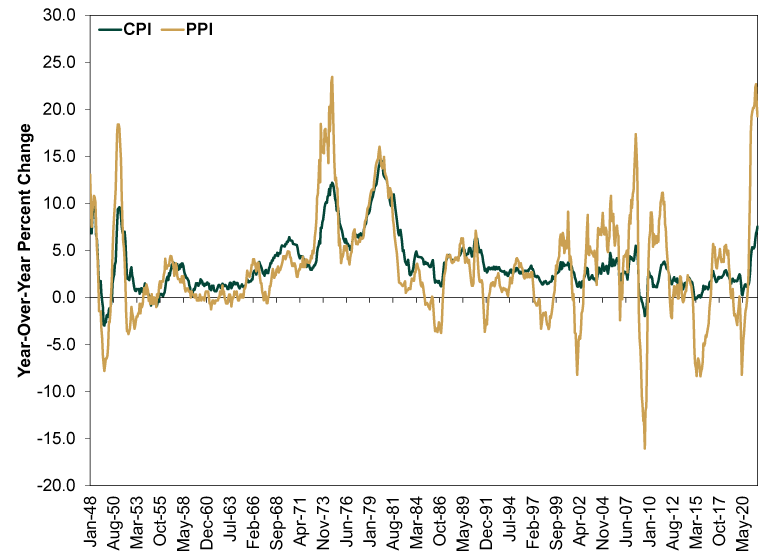

The headline PPI, known as Final Demand PPI, isn’t that old. But the legacy PPI for all commodities, which dates to 1913, has a similar relationship with CPI. As Exhibit 2 shows, while it is much more volatile than Final Demand PPI, its ups and downs follow the same track, and it moves more or less coincidentally with CPI.

Exhibit 2: A Longer, More Volatile Version of Exhibit 1

Source: St. Louis Federal Reserve, as of 2/15/2022. Consumer Price Index (All Items, US City Average) and Producer Price Index: All Commodities, January 1948 – January 2022.

As you probably also noticed, PPI almost always runs higher and is more volatile than CPI—a fact that hopefully brings further comfort today. We delved into the reasons for this in our “What We’re Reading” sidebar today, but in short, PPI focuses on goods prices, which tend to swing much more than services. CPI, by contrast, is about 60% services.[ii] That means PPI also excludes imputed rent—a made-up figure that represents about one-fourth of the CPI basket. But it does include the prices health insurers pay providers for covered procedures, which is often much higher than insured patients’ out-of-pocket costs. The legacy PPI gets further skew from the fact that energy prices comprise about one-fifth of the index—much higher than their weights in CPI and the modern PPI.

Now, none of this predicts what prices do next. PPI and CPI aren’t serially correlated—one month doesn’t predict the next. But it does argue against CPI jumping this spring just because businesses’ costs rose in January. Whenever CPI starts easing, it will likely do so alongside PPI, not after it.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments has developed several informational and educational guides tackling a variety of investing topics.