Personal Wealth Management / Market Analysis

Why Greece Isn’t the Bull Market’s Achilles Heel—in Pictures!

Here are 10 graphs and charts showing why we don't believe Greece is a threat to the bull market.

Five years ago this week, the EU, IMF and ECB unveiled a €110 billion euro Greek bailout intended to avert default and shock and awe then-volatile markets into quietude. So much for that plan. After five years, the development of two additional euro-area wide bailout mechanisms, a second Greek bailout and two debt defaults, Greece remains the eurozone's sore thumb. Lately, developments have gotten increasingly bizarre. Greek leadership seems to flip-flop near daily, even shiftingwho is doing the negotiating with their creditors. A deal is claimed near, then the expected arrival date is postponed. We could document all these theatrics here, which would entertain us to no end[i] but probably do you little good. Instead, let's look at some charts that help illustrate why whatever happens in Greece-compromise, default within the euro, Grexit-doesn't pose much of a threat to the bull market.

Greece, on its own, is simply too small to inflict much harm. If Greece were a US metropolitan area, its GDP of roughly $200 billion would rank it roughly 15th nationally, about $13 billion behind Detroit, whose 2013 default didn't so cause as much as a blip in financial markets. Its debt load is bigger than Greece is itself-about the size of Boston-but very little of this is held by the private sector. (Exhibits 1, 2 and 3) A big slice of the privately held debt is owned by vulture funds-funds that intentionally buy distressed debt on the cheap, seeking a settlement or payout later.[ii]

Exhibit 1: Scaling Greece Against US Metro Area GDP

Source: US Bureau of Economic Analysis, Eurostat, as of 5/7/2015. 2013 GDP by Metro Area and Greece 2014 GDP.

Exhibit 2: Share of Greek Central Government Debt Owned by International Banks

Source: Bank for International Settlements, Bank of Greece. June 2005 - September 2014. (HT Christo Barker)

Exhibit 3: Who Actually Owns Greek Debt?

Source: Bank for International Settlements, Bank of Greece, as of 4/8/2015. (HT Christo Barker)

Some might worry about the impact on sovereign finances, but the ownership is spread far and wide and distributed based largely on economic clout. Relative to eurozone GDP and tax receipts, eurozone sovereigns' Greek exposure amounts to 1.8% of the region's GDP and 5.1% of tax revenue-not ideal, but manageable. And those figures presume a total loss in a potential Greek default.

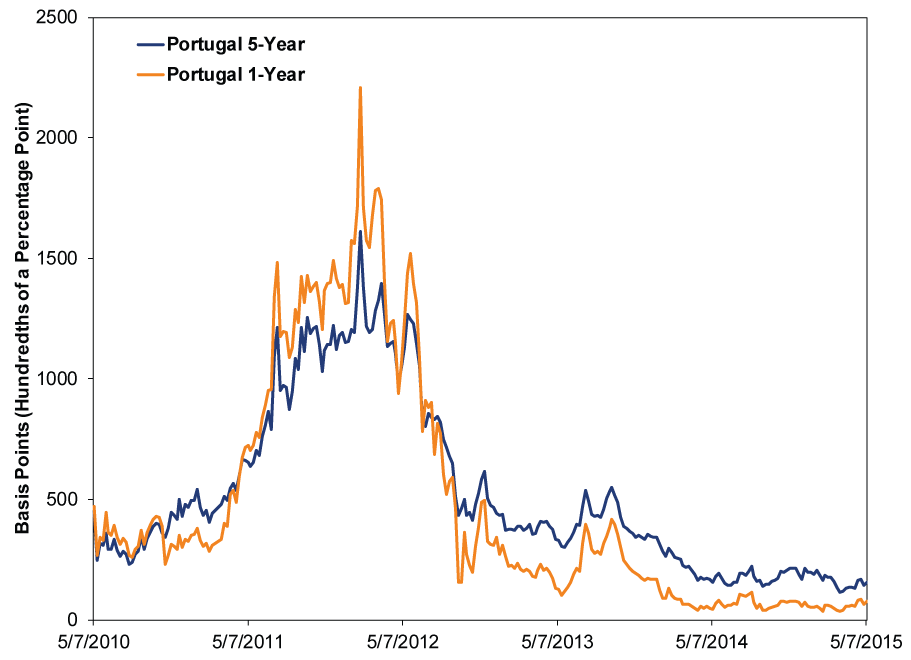

Here you might ask, "What about contagion? Any material sign?" Answer: No. Greece's rising bond yields since last winter are detached from other eurozone nations'. (Exhibit 4) Greece's falling stocks are an outlier in an overall rallying eurozone to start the year. (Exhibit 5) The costs to insure against default (credit default swap rates, CDS) for Portugal, Spain, Italy and Ireland are basically flat year-to-date. (Exhibits 6 - 9) Meanwhile, Greek CDS are spiking, and Greek 1-year CDS rates are above 5-year-this suggests the market is pricing in some form of credit event, as a seller would ordinarily demand higher compensation to insure debt for longer. (Exhibit 10)

Exhibit 4: Peripheral Eurozone 10-Year Sovereign Bond Yields

Source: Factset, as of 5/7/2015. 12/31/2009 - 05/06/2015.

Exhibit 5: MSCI European Economic and Monetary Union Index and Constituent Countries Vs. MSCI Greece in 2015

Source: Factset, as of 5/8/2015. Year to date returns for indicated nations' stocks as measured by MSCI's index for each, in USD with net dividends.

Exhibit 6: Spain 1- and 5-Year CDS

Source: Factset, as of 5/8/2015, 5/7/2010 - 5/7/2015.

Exhibit 7: Italy 1- and 5-Year CDS

Source: Factset, as of 5/8/2015, 5/7/2010 - 5/7/2015.

Exhibit 8: Ireland 1- and 5-Year CDS

Source: Factset, as of 5/8/2015, 5/7/2010 - 5/7/2015.

Exhibit 9: Portugal 1- and 5-Year CDS

Source: Factset, as of 5/8/2015, 5/7/2010 - 5/7/2015.

Exhibit 10: Greece 1- and 5-Year CDS

Source: Factset, as of 5/8/2015, 5/7/2010 - 5/7/2015.

If you enjoy political soap operas, by all means, follow every twist and turn of the Greek saga. But we'd suggest doing so for entertainment purposes only, because there is little-to-no sign whatever happens there will be relevant to markets outside Greece.

Stock Market Outlook

Like what you read? Interested in market analysis for your portfolio? Why not download our in-depth analysis of current investing conditions and our forecast for the period ahead. Our latest report looks at key stock market drivers including market, political, and economic factors. Click Here for More!

[i] Trust us, we really enjoy a good rant about privatization, especially those including Greek mythology metaphors and whatnot.

[ii] You can ask Cristina Kirchner for more detail on these funds, if you like.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments has developed several informational and educational guides tackling a variety of investing topics.