Top-Down Investment Approach

Investors use a variety of approaches to construct and manage portfolios. Two common approaches to portfolio construction are top-down and bottom-up investing. A top-down process generally places more emphasis on macroeconomic forecasts than on individual stock picking—which is the primary focus in a bottom-up investing process. Fisher Investments employs a largely top-down process that incorporates broad economic factors into every step—from our overall market forecast down to the individual securities we select—helping to ensure strategic cohesion.

Pitfalls of Solely Relying on a Bottom-Up Investment Approach

A bottom-up approach typically relies on picking individual securities (stocks, bonds, etc.) as the primary driver of investment returns. Bottom-up approaches can have several limitations, such as the tendency to over-concentrate in a certain category of securities. If an investor only picks securities they believe will perform best or only specializes in one part of the market, it can leave the portfolio narrowly focused. If other areas of the market perform better, then the concentrated portfolio misses out.

Investors who only use a bottom-up investing approach often de-emphasize the importance of broader economic cycles—and rely on scouring thousands of companies in an attempt to pick the “right” ones. But even the best companies aren’t immune to macroeconomic trends. Even if an investor manages to pick the best company within a sector, if the sector overall does poorly, the company may still suffer. For example, imagine picking the “best” bank in the 2008-2009 global financial crisis! Many investors and industry professionals still tend to take a solely bottom-up approach despite its potential limitations.

Why We Prefer a Top-Down Approach to Investing

Rather than looking for the needle in the haystack, we believe it’s better to look for the haystack with the most needles. A top-down approach utilizes broad economic analysis where market forecasts drive tactical decisions. This requires analyzing a wide variety of macroeconomic factors before selecting securities. Our economic forecast drives an asset allocation decision—the portfolio’s mix of stocks, bonds, cash and other securities. For example, a positive forecast may warrant high exposure to equities whereas a negative forecast may warrant higher exposure to cash. We then identify areas of the market—countries, sectors and styles—we expect to perform better or worse than other areas, seeking to diversify the strategy appropriately. From there, we can select the individual securities that align with our high-level views.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments has developed several informational and educational guides tackling a variety of investing topics.

Importantly, we believe this approach better focuses on the primary driver of a portfolio’s returns over time—asset allocation. Consider an extreme example—an all-cash portfolio versus an all-stock portfolio. Over time, there will be a big difference between how they perform. The difference will be much bigger than that of two all-stock portfolios, regardless of the stocks in them. Therefore, we believe investors should spend more time correctly identifying which asset allocation is appropriate for the period ahead before attempting to select individual stocks.

We also believe top-down investing gives us more flexibility to make tactical decisions amid constantly evolving market conditions. It allows us to adjust a portfolio’s asset and sub-asset—the mix of countries, sectors and styles— allocation depending on our forecast.

We also leverage our global economic analysis across countries, sectors and styles (size, growth vs. value, etc.) to help determine where we are in a market cycle and which areas of the market we want exposure to. For example, large growth-oriented companies tend to outperform in later stage market cycles. If this category is doing particularly well, it may suggest the market cycle is nearing its end.

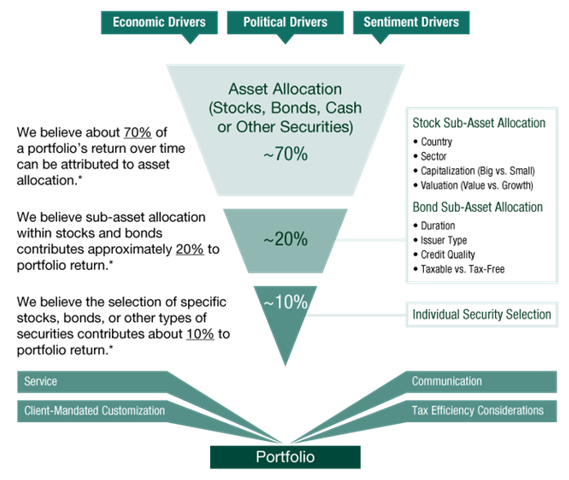

Our Top-Down Approach to Investing: 70/20/10

We believe 70% of investment returns are attributable to a portfolio’s asset allocation, 20% to sub-asset allocation, and 10% to the selection of individual securities. Exhibit 1 shows the progression of our 70/20/10 model for reference:

Exhibit 1: Fisher Investments’ 70/20/10 Investment Approach

*Forward-looking return attribution is an approximation intended for illustrative purposes and should not be considered a forecast of future returns or return attribution.

Here is a more detailed look at each step in the process:

- 70%: Asset allocation: We determine a portfolio’s mix of stocks, bonds, cash and other assets by first understanding an investor’s financial goals and needs. From there we apply macroeconomic analysis to tactically adjust the asset allocation, if necessary, to align with our market forecast. We study economic, political and sentiment drivers to help make this decision. Because asset allocation is a crucial factor contributing to returns, we treat it as the highest-level decision.

- 20%: Sub-asset allocation We narrow down a list of possible assets based on characteristics, such as country, sector and style. We combine historical analysis with forward looking views to determine which categories are likely to outperform. We also develop a counter strategy—having some exposure to areas we don’t expect to outperform—to ensure proper diversification.

- 10%: Security selection: We conduct fundamental analysis to select individual securities that fit our sub-asset allocation decisions. The first two steps provide a framework for which securities to consider.

Putting It Together: A Top-Down Approach on Two Main Levels

Think Strategically: Select Assets to Match Your Goals

If you are an individual investor, how do you apply a top-down strategy? To start, your long-term goals should help shape your investment plan. A well-designed portfolio should be personalized to match your individual financial situation. Since every investor is different, there is no magic formula for the right mix of assets. It depends on your unique set of financial goals, needs and appetite for risk.

If you have significant growth needs, your portfolio may want to have greater exposure to assets that have historically provided higher returns with high short-term volatility—like stocks. If you require less portfolio growth and need more cash flow, your portfolio may want more exposure to assets with historically lower returns and lower short-term volatility—like bonds.

You should put a lot of thought into what mix of asset classes will most likely get you to your goals. In most cases, this strategic decision should only change when your circumstances or needs materially change. In other words, it should be independent of the current market environment and based on your desired long-term outcomes.

At Fisher Investments, we thoroughly review each client’s financial situation and goals to recommend an optimal asset allocation designed to achieve success.

Think Tactically: Use Market Forecasts to Adjust Your Asset Selection

Once you have identified the right asset mix to match your goals, you can then make decisions on a tactical level to try to improve your portfolio’s performance over time.

Your market forecasting will likely drive most of these decisions. Here are a couple of examples:

- Asset Allocation: If your research leads you to believe a prolonged stock market downturn will likely occur in the near term, you may consider decreasing your exposure to equities. However, this can be dangerous if done too frequently or at the wrong time. Having a third party involved—like an adviser—is often helpful to keep you on track to reach your goals.

- Sub-Asset Allocation: Based on your views, you may wish to hold fewer securities in areas you think might underperform the overall market and hold more of what you believe might outperform. For example, if you anticipate Energy stocks will outperform, you might choose to hold more Energy companies. However, you may want to avoid holding too many assets in a given sector or particular region of the world, as that can magnify your risk.

Portfolio management is complex. Market conditions are always changing and financial media often muddies the picture. Having a trusted adviser—like Fisher Investments—do the research and keep you focused on your long-term financial goals can give you some peace of mind and helpful counsel.

Our Investment Philosophy

We believe a top-down investment approach—one that selects assets based on higher-level analysis before security selection—is a key factor to our investing success. To learn more about Fisher Investments and our top-down investment process, download one of our guides or contact us at (888) 823-9566 to speak with one of our qualified professionals today.

The approaches presented herein are for illustrative purpose only. It should not be assumed that these represent, on their own, the sole method used by Fisher Investments to make investment recommendations. Other techniques may produce different results, and the results for individual clients and for different periods may vary depending on market conditions and the composition of their portfolios. Any mention of a particular approach in this illustration is not intended to represent a recommendation to buy or sell a security. Rather, it is intended to illustrate a point. It should not be assumed that the future of any approach mentioned will be profitable. Investment in securities involves the risk of loss. Past performance is no guarantee of future returns.