Free Administrator Toolkits

We know administering your company's 401(k) plan can be complex and confusing, that's why we created free administrator toolkits to help make your job easier.

Common 401(k) Plan Red Flags

-

Get Toolkit

-

Resources

-

Articles

401(k) Scorecard

Find out how your business's 401(k) stacks up against industry peers by requesting your free personalized 401(k) scorecard.

Fund Lineup Checklist

When was the last time you reviewed the fund lineup in your company’s 401(k) plan? Use our checklist to identify opportunities to improve your fund lineup.

401(k) Audit Guide for Employers

Use this guide to help you maintain a fiduciary audit file in the case of an audit by the IRS or the Department of Labor.

Free 404(c) Checklist

Use this checklist to reduce your fiduciary liability by making sure your company’s retirement plan qualifies for ERISA 404(c) protection.

Common 401(k) Plan Administrative Mistakes

This reference for 401(k) Plan Administrators offers some of the most common mistakes that happen when administering a business's 401(k) plan.

401(k) Employee Participation: Why It Matters

Increase 401(k) participation and help make your 401(k) plan one of the most compelling benefits for attracting and retaining top talent.

401(k) Basics for Plan Administrators

-

Get Toolkit

-

Resources

-

Articles

2023 Compliance Calendar and Checklist

Use this 401(k) calendar and checklist to make sure you’re on top of administering your company’s plan.

How to File Form 5500

Learn how to file the Form 5500 for your small business 401(k) with these step-by-step instructions.

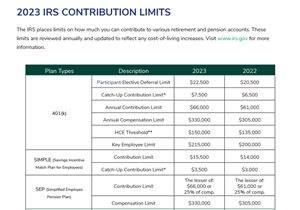

2023 IRS Contribution Limits

The IRS places limits on how much individuals can contribute to various retirement and pension accounts. Use this chart as a quick reference for the 2023 contribution limits.

Types of Profit Sharing Plans

What is a Profit Sharing Plan? Why are Profit Sharing Plans good for small businesses? Get the answers to your most pressing questions about Profit Sharing Plans.

Reasons Your Employees Will Love a Roth 401(k)

Learn about the benefits of a Roth 401k plan and why employees love it. Get the help needed to decide if adding a Roth option is right for your businesses.

401(k) Plan Design

Find out about 401(k) plan design and the retirement plan features that might work best for your company and your employees.

Calculating Retirement Plan Fees

-

Get Toolkit

-

Resources

-

Articles

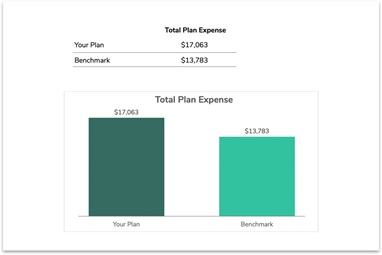

Plan Costs Guide

Our plan cost guide provides step-by step instructions to help you calculate plan fees.

Fee Estimator

Use the cost estimator to help you quantify your plan costs and estimate the amount of fees your 401(k) plan currently pays.

Plan Costs Case Study

Read what this plan sponsor uncovered when they calculated their plan fees and what they did to lower their fees, upgrade the service on their plan, and eliminate revenue sharing.

Are You Getting A Good Value?

As the sponsor of your company’s 401(k) plan, you may be tempted to cut up-front costs by going with a plan advisor who charges lower fees but is that truly the best deal?

Trojan Horse That Can Crush Your Company 401(k)

Most 401(k) plans include several fund options in which your participants can invest. However, the fee structures of these funds are not all created equal.

Why Work With Fisher?

Fisher redefines what it means to be a partner in retirement by providing superior guidance, unparalleled service and simple and easy program administration.

Contact Us

Your Interests First

Incentive structures that are aligned with your success. No revenue sharing, no kick-backs or commissions. When you do better, we do better.

DIFY (Do It For You) Approach

Our servicing solutions focus on doing everything we can for you. From acting as a single point-of-contact for your plan to selecting your investments, we provide services that many other advisors can’t or won’t provide.

Superior Financial Guidance

As one of America’s top financial advisers, we work with you to build the optimal program and provide ongoing one-on-one financial guidance to maximize wealth generation.

Small Business Expertise

We specialize in small business retirement plans. As a result, we act as your advocate and have the knowledge, resources and clout to champion your needs.