Personal Wealth Management / Market Analysis

Hurricanes and Broken Windows

Examining the potential economic and market impact of natural disasters.

The human impact of hurricanes and other natural disasters is undeniably tragic, and our hearts go out to those affected by Hurricane Sandy. However, its economic and market impacts seem to be in great debate. Some folks (without discounting the temporary disruption to lives and property) posit natural disasters can leave communities and the economy better off in the long term. Other folks even argue short-term benefits are immediately evident. We suggest those folks find their Macroeconomics 101 textbooks, flip to the index and find the “broken windows fallacy.”

The broken windows fallacy utilizes the parable of a baker whose window is broken by a hooligan. As the fallacy goes, many folks think the baker’s broken window stimulates the economy. The baker must replace the window, so he hires a contractor to fix it—a cost to the baker, boon to the contractor. Now, the contractor has money to spend he wouldn’t have (had the hooligan not broken the window.) Of course, there’s also the multiplier effect. The contractor must purchase a new window from the window maker, who employs a glazer and so on. Thus, believers argue, the economy in aggregate gains as a result of the broken window.

But before planning to employ many in the burgeoning field of hooliganism, consider the fallacy. You see, the baker could have used the money he had to spend replacing his broken window for other things—perhaps new baking equipment that would enable him to bake more delicious treats to sell—generating another source of income he could then spend again elsewhere in the economy. Perhaps he might invest that extra capital into additional bakeries that could employ more people (and potentially prevent those same people from turning to window-breaking hooliganism). Of course, the multiplier effect applies here, too. The bakery equipment maker would have also gained, as would the truck driver who delivered the equipment to the baker, and so on. And the baker, of course, would have new, productive equipment that adds to the economy (and a still-whole window)!

Case in point, if destruction did indeed have a positive impact on the economy, wouldn’t folks be running amok destroying homes and windows at the prospect of every recession?

What we gather from the broken windows fallacy is the value of what’s destroyed (or money not spent productively as a result) is overall and on average equal to the value added by replacing the window. As in not “good for the economy.” We’d say negligible at very best. In fact, historically there’s no consistent pattern of diminished aggregate economic activity following natural disasters. Obviously there are negative impacts from disruptions to normal economic activity and short-term boosts during reconstruction, but on balance, these offset each other in the long term.

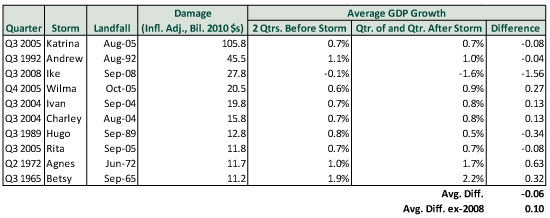

Exhibit 1 shows the US GDP impact of the 10 costliest hurricanes in history. There’s little, if any, consistent negative or positive impact. The average difference is just -0.06 percentage points. Of course, this calculation also includes various externalities to hurricanes—2008’s financial crisis, for example. Excluding 2008’s impact, the average difference is a mere 0.10 percentage points.

Exhibit 1: US GDP Impact of Costliest Hurricanes

Sources: National Hurricane Center, Thomson Reuters, FI Research.

Stocks too show little, if any, direct long-term impact as a result of natural disasters. Using the same 10 hurricanes as an example, we could find no direct relation to market returns in the long term. Instead, market returns seem more a product of external factors. Again—like 2008’s financial crisis or, in most other cases, ongoing bull markets.

We hope those affected by Hurricane Sandy recover and rebuild in short order. But as investors, hurricanes and other natural disasters should serve as an unfortunate reminder these huge, negative events are always possible, but the market and economic impact of them in the long term is nothing more than negligible at best and fleeting at worst.

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights

Sign up for our weekly e-mail newsletter.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments has developed several informational and educational guides tackling a variety of investing topics.