Personal Wealth Management /

Longer Lives and Other First World Problems

Contrary to media myth, an allegedly aging population is not the great economic scourge of our time.

Those darned kids amounted to something, and now the world fears their retirement. Photo by John Minihan/Getty Images.

Trivia time: What do climate change, income inequality, rising US debt, demographics and every asteroid ever rumored to be on a collision course with Earth have in common? Nothing! Except this: None have anything to do with stock returns.

Interested in market analysis for your portfolio? Our latest report looks at key stock market drivers including market, political, and economic factors. Click Here for More!

We feel compelled to point this out after seeing a few pieces warning the US faces decades of subpar growth and stock returns because of an "aging population." Some say we're already living it, with recent years' slow growth and low inflation coinciding with a 6.3% drop in the amount of time the average American spent working between 2003 and 2013. And before you can say "interesting observation," the doom-and-gloom demographers (is there any other kind) offer two bits of supporting ... um ... evidence. One: The utterly asinine theory that the over-65 set is a societal drain. Two: Japan.

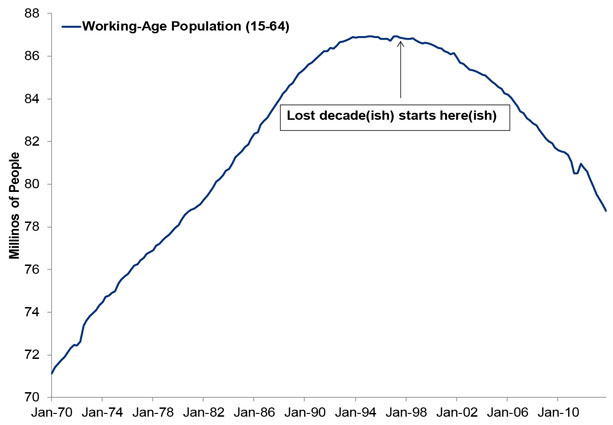

Exhibit 1: Japan's Working Age Population

Source: St. Louis Federal Reserve, as of 6/23/2014.

Now, we won't belabor Japan (promise). But to say its 15-plus years of shrinking nominal GDP, deflation and blah returns are a function of population trends ignores a host of other structural issues. If demographics explained Japan's "lost decade," Shinzo Abe wouldn't be trying to cut taxes, free trade, improve corporate governance and reform the rigid labor code. He'd just offer subsidies for babies, a policy we don't think would be very contentious.

But we digress. This story is about the US, and there isn't much (any) evidence seemingly negative population trends are bad for stocks or the economy. For example, the 15 to 24-year-old end of the working age population shrank by over 5 million between 1980 and 1989-a demographic cliff! But the 1980s were a boom. That segment of the population largely stagnated through the early and mid-90s-another boom. But then it bounced back and is now at all-time highs. That's another thing. Population trends aren't permanent! They change! You can't extrapolate them out decades ahead.

But even if you could, it wouldn't matter for stocks. Demographic changes play out glacially-slow moves over huge stretches of time. They aren't a surprise. Folks didn't just wake up and realize the first Baby Boomers were turning 65 in 2011-Boomer doom-and-gloomers have been around for well over a decade. Markets have heard for years that retiring Boomers will dump stocks, spend less and drain Social Security and Medicare. Markets are also aware these are opinions and theory, not destiny. Stocks have heard the warnings, considered them, and kept rising anyway. That isn't an irrational disconnect. It's just the market telling you the chorus is wrong.

Call us Pollyanna, but we think an aging population is a pretty darned good problem to have. It's a sign of just how good quality of life is today! Thanks to the wonders of modern medicine, folks are living longer-a lot longer-than ever before. The average American's life expectancy is up from 70.5 years in 1969 to 78.5 years today. And contrary to the popular meme, the average retiree isn't spending all their time sleeping, watching TV, playing shuffleboard and being an overall drain on society. Nope! They're out and about! Spending! Shopping, traveling, exercising, spoiling grandkids, volunteering, maybe working part-time to keep busy and stay social, taking up new hobbies, catching up on books they never got to read-you get the drift. They also consume more health care services than ever before. Simply, seniors aren't an economic drain. They're vibrant, vital contributors. Perhaps some own fewer stocks, yes, but some sell their businesses and reinvest the proceeds. The idea we're doomed to sluggish long-term growth and markets because of them lacks evidentiary support.

Anyone claiming demographics matter for stocks is trying to extract an economic forecast from an opinion about human behavior and generational potential-opinions that have proved flawed since about always. Heck, once upon a time, folks feared the now-vaunted Boomers wouldn't amount to a hill of beans-too much time wearing flowered headbands, holding hands and singing "Blowin' in the Wind" while indulging in a substance only recently legalized in two states, not enough time working. These are the same Boomers most now credit for driving the economic glory days we're allegedly doomed never to see again. The handwritten lyrics to "Like a Rolling Stone" are expected to rake in a cool $2 million at auction, so some fan somewhere must have made something of him or herself. Generation X was supposed to be a bunch of sad sacks lazing around coffee houses in second-hand flannel, too apathetic to have the drive to work. They grew up, too. Now the Millennials are supposedly a "lost generation" of wasted youth who came of age in Zucotti Park, refuse to buy stocks post-2008 and can't buy homes because they're saddled with student debt. Maybe the "kids today" logic is right this time but maybe, just maybe, the kids are alright.

Look. If long-term demography-based forecasts were right, the Dow would have hit 35,000 in 2009. It didn't. And any population-based forecasts-whether doom for the first world or boom for the third world-won't be any more correct. Population trends are simply part of the long-term backdrop for an economy and society. Yes, labor is an important economic input, but it's just one of four-resources, technology and capital matter, too. Capital isn't fixed, and technology moves fast-much faster than populations. The shale boom put a stake in "peak oil." Maybe advances in robotics will address "peak people!" Maybe one Japanese firm's plans to market humanoid robots as assistants for the elderly is just the beginning! Maybe that drives all sorts of new opportunities and growth over the very long term-and new sources of corporate earnings-regardless of the number of workers!

But that's all too far in the future for markets to think much about today. We're at now now. Markets generally look hardest at the next 12 to 18 months, and they move most on the gap between folks' expectations and the likely reality within that window. Social issues that play out over decades are interesting to think about from an academic standpoint, but they shouldn't factor into investors' decisions today.

Stock Market Outlook

Like what you read? Interested in market analysis for your portfolio? Why not download our in-depth analysis of current investing conditions and our forecast for the period ahead. Our latest report looks at key stock market drivers including market, political, and economic factors. Click Here for More!

If you would like to contact the editors responsible for this article, please message MarketMinder directly.

*The content contained in this article represents only the opinions and viewpoints of the Fisher Investments editorial staff.

Get a weekly roundup of our market insights.

Sign up for our weekly e-mail newsletter.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments has developed several informational and educational guides tackling a variety of investing topics.