Determining Your Investment Time Horizon

Fisher Investments has been helping investors plan their retirements for over 40 years. During that time, we’ve found the risk investors fear most is running out of money in retirement. One way this fear could become a reality is by underestimating your investment time horizon.

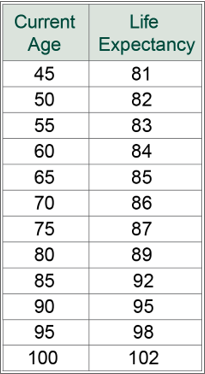

Investors thinking about retirement often overemphasize the age at which they plan to retire, and then spend too little time thinking about how long they expect to live in retirement. Since average life expectancies have increased over the past century, you may need your retirement investments to last for 30 or more years.

In Fisher Investments’ view, a better approach to retirement planning begins by understanding your investment time horizon and planning for the long-term so you don't risk running out of money.

What is Your Investment Time Horizon?

Your investment time horizon is the length of time you need your retirement assets to work for you. Your average life expectancy is a good starting point when determining your investment time horizon, but relying on average life expectancies can underestimate how long you will likely live.

New medical advancements are helping people to live longer than ever before, so your investment strategy should account for a longer-term time horizon.

Exhibit 1 below shows total life expectancies for Americans based on their current age. These projections are just averages, so, by definition, that means that half the population could expect to live longer than the average. That’s why we believe it’s suboptimal to use only average life expectancy for retirement planning purposes.

Exhibit 1: Average Life Expectancies

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments has developed several informational and educational guides tackling a variety of investing topics.

Source: 2022 US Total Population Life Table, National Vital Statistics Reports, Volume 70, Number 19. Life expectancy rounded to nearest year. https://www.cdc.gov/nchs/data/nvsr/nvsr70/nvsr70-19.pdf

If you are an active individual in good health, with parents who lived into their 80s, you could beat the averages. Don't put a secure finical situation in retirement at risk with poor investment decisions based on average life expectancies.

Incorporating Your Long-Term Goals

Your financial goals and objectives are also important in determining your investment time horizon. Maybe you want to leave a legacy for your children and grandchildren—meaning your investment time horizon goes beyond your own lifetime. Goals like these will ultimately affect your cash flow needs in retirement, and if you have underestimated your investment time horizon, you may risk choosing between providing for yourself or providing for your family. That’s a predicament no one wants to face.

Optimal Asset Allocation

Once you have determined your investment time horizon, the next step is using it as the basis for a diversified portfolio with the proper asset allocation. Asset allocation is the mix of stocks, bonds, cash and other securities in your portfolio. We believe asset allocation is the single greatest determinant of portfolio returns and your likelihood of being able to afford the retirement you want.

Other factors that help determine your appropriate asset allocation include return expectations, cash flow requirements, risk tolerance and liquidity needs.

When investors hear their asset allocation could determine if they run out of money or live comfortably, they instinctively want to play it safe. Some investors think that when they retire, their risk tolerance declines so they should invest in more-conservative, lower-yielding securities with less risk (i.e., bonds and certificates of deposit).

But that approach could actually carry more risk!

Investing in lower-return investments for the sake of less short-term volatility may not provide you enough growth to help sustain your investment goals across your entire investment time horizon. Being too conservative could leave you in a difficult position if you live longer than expected or plan to support your spouse or beneficiaries after you’re gone.

Too often, investors fear short-term stock market volatility and shy away from investing equities because they’re deemed more “risky.” But, to meet your longer-term growth needs for your investment time horizon, you will likely need to invest in stocks.

Risk-Return Trade-off

There is a common misperception that bonds are less risky assets because they have lower short-term volatility than stocks. Retirees looking to avoid short-term volatility sometimes opt for fixed income, a decisions that potentially neglects their long-term return needs.

Data show that, over the long-term, equities have had higher historical average returns than fixed income. That longer-term growth potential of stocks comes at a price: higher short-term market volatility.

However, over the long-term, stocks’ return variability tends to decline and fall below that of bonds. Exhibits 2 and 3 illustrate this effect with hypothetical portfolios using varying allocations to stocks and bonds.

Over a five-year time frame, portfolios with heavy stock allocations not only have higher growth potential, but also see higher return variability, measured by standard deviation.* But, when you look at a 30-year time horizon—a better proxy for most long-term time horizons—you see that portfolios weighted toward stocks have maintained higher average returns with lower return variability than portfolios with more bond exposure.

Exhibit 2: 5-Year Time Horizon

Exhibit 3: 30-Year Time Horizon

*Standard deviation represents the degree of fluctuations in historical returns. The risk measure is applied to 5- and 30-year annualized returns in the above charts.

What Can You Do?

Our Investment Counselors seek to understand our clients’ financial needs and will regularly check-in to make sure their investment goals remain consistent with your original objectives and investment time horizon. Call us at 1 (888) 823-9566 or contact us online to learn more.