Variable Annuities

Market-like growth and less risk than stocks.

That’s the frequent sales pitch from those selling variable annuities. Unfortunately, reality is a little more complicated.

Variable annuities can often be confusing, even to the people selling them. Variable annuity contracts come in a variety of forms with a bewildering array of terms and conditions. These provisions require close examination because they can have a material impact on your ultimate return.

Fisher Investments has helped many clients navigate annuity contracts and their associated issues. We believe a clear understanding of what investing in annuities entails is critical. This will allow meaningful comparison with other available investment options.

Features of Variable Annuities

Variable annuities are insurance products that promise a stream of income at some future time in exchange for premium payments. Like other annuities, variable contracts have both an accumulation phase, as well as a payout phase.

The main difference between variable annuities and other types is the accumulation phase’s fluctuating rate of return. Premium payments are invested in securities. The annuity owner can direct those funds into various “sub-accounts,” which work much like mutual funds. Returns from this type of annuity are “variable” because the gains or losses from the investments determine the investor’s overall return.

This arrangement allows deposits to fluctuate during the accumulation period. Theoretically, this should lead to a potentially larger payout income stream than a fixed annuity could provide. However, losses are also a possibility. We’ll discuss this more later, but it’s important to note that variable annuities don’t protect you from loss.

Regulators consider variable annuities to be securities, like stocks or bonds. That means variable annuities must be registered with the Securities and Exchange Commission (SEC), as well as with state insurance regulators.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments has developed several informational and educational guides tackling a variety of investing topics.

Risks Involved

Variable annuity salespeople typically target investors concerned about a market downturn causing them to outlive their assets, a situation sometimes called “longevity risk.” These salespeople use terms such as “guaranteed income” or “lifetime income” to emphasize the sense of safety.

This leads investors to see the annuity as a way to transfer their longevity risk to the insurer. However, the way in which the insurance company structures the variable annuity can have a significant impact on the actual results.

Riders and fees can offset potential returns

Salespeople can be quick to mention an annuity’s beneficial guarantees. However, they frequently neglect to say that many of these benefits must be purchased as riders to the annuity contract. A rider is an add-on provision that provides extra features at an additional cost. Variable annuities typically have annual fees of as much as 2.31%1 before rider fees are factored in. Such features can create a strong headwind for your investments if you hope to see your deposits grow.

It’s also important to realize that as attractive as these features can seem, there can often be conditions and stipulations. You should evaluate your annuity based on the contract’s detailed terms, not on what your salesperson says. For example, a rider for protection against loss usually only protects your deposits, not any gains on the investments. And if you want to transfer the annuity benefit to your spouse or heirs, you may have to purchase another rider.

Inflation hurts your purchasing power

The “guaranteed” nature of future payouts can attract investors, despite an annuity’s high fees. However, even a “guaranteed” payment doesn’t automatically address one of the biggest factors that can eat away at your purchasing power over time: inflation.

Most annuity riders don’t adjust for inflation. So, unless you purchase a rider—with another fee, of course—specifically to dampen inflation’s impact, over time your “guaranteed” payment purchasing power can suffer.

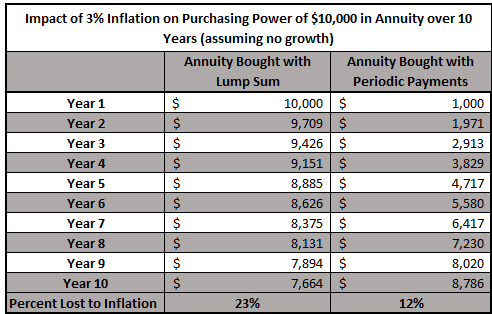

Here is an example of how inflation could erode purchasing power in an annuity owned for 10 years. The example below contains the following assumptions:

- annuity purchased with a lump-sum payment

- no investment growth

- inflation held to its historical rate of around 3%2

As the table shows, inflation erodes the original purchasing power of $10,000 over time. After 10 years, total payments would have lost around 23% of their original value.

Even if you were to assume your deposits are made evenly, inflation still would have cost you roughly 12% in purchasing power. Importantly, neither scenario considers the fees charged over the years, making these outcomes look even worse.

Recapping the Risks of Variable Annuities

As this section demonstrates, the reassurances you might hope to gain from a variable annuity are rarely straightforward. Features that seem most beneficial can often turn out to be underwhelming when examined in detail. Your individual needs and circumstances will determine whether or not an annuity’s trade-offs make sense for you. However, in our view, there are many situations where less expensive strategies might accomplish the same benefits offered by variable annuities.

To recap, remember the following when considering a variable annuity contract:

- Principal at risk: Unlike some other types of annuities, the principal in variable annuities can be lost. Investors can protect themselves against this risk, but it typically requires they purchase a rider. This further complicates the product and adds to what they’ll pay for the “security” they seek.

- Inflation: Annuity payments don’t always keep pace with inflation, depending on their terms. If your cost of living rises and your income stream doesn’t, your retirement lifestyle could be in peril if your purchasing power fades over time.

- Inflexibility: Variable annuities usually have significant barriers that can make exiting the contract difficult. If you need money before the payout phase, even for an emergency or an investment opportunity, you may not be able to withdraw funds without incurring a serious penalty. Penalties may dwindle or disappear over time, but that often happens seven years or more from purchase.

- Insurer insolvency: Insurance company default rates may be low, but you still have to assess the risk of your annuity contract issuer going bankrupt. If this happens, your retirement nest egg often goes with it.

The Fee Burdens of Variable Annuities

Variable annuities are commissioned investment products. Someone is going to be paid handsomely for selling a variable annuity to you, whether through an upfront sales fee or an annual commission.

Of course, upfront sales fees and commissions are just the tip of the iceberg. There are also annual fees associated with annuity contracts. These charges can vary, but they generally include a fee of at least 1.4% (according to the SEC)3 simply to cover the annuity’s cost. Remember, money in a variable annuity is likely to be invested in mutual funds, which also charge fees (averaging 0.94%)4. Factor in a couple of common riders, like a Minimum Death Benefit (0.51%)5 and Guaranteed Lifetime Withdrawal Benefit (1.06%)6, and your fees might reach as high as 3.9%. In isolation, these fees may seem only marginally expensive, but when compounded over the lifetime of your variable annuity, your ability to maximize returns could prove very challenging.

To highlight the compounding effect of variable annuity fees, let’s use our example rates above for the following scenario: Assume you invested a modest $10,000 lump sum in a variable annuity. Your money is invested in a fund earning an average return of 10% annually over 10 years. After applying the annuity’s fees and factoring in compounding interest, you’d end up with just over $17,000 through the annuity period. If you had purchased that same fund directly—minus the annuity-specific fees—you could have ended up with nearly $22,000 after the same time period.

In this example, the annuity ends up eating nearly $5,000 in potential gains! Why not just invest directly in mutual funds? After all, there are less complicated ways to get middling returns.

Surrender Charges for Variable Annuities

As discussed, variable annuities can be expensive and lack the customization you seek for your retirement plan. So, what happens if you change your mind about an annuity you own? Even more importantly, what might happen if you need to take money out of your annuity for an unexpected expense?

Unfortunately, if you wish to withdraw money earlier than intended, you are likely to incur a surrender charge. Additionally, taking out more than the contract’s allowable amount could reduce the benefits of any riders you’ve purchased.

Fisher Investments has analyzed thousands of annuities over the years and we have found initial-year surrender charges can be high. A typical surrender fee might be 7% in the first year, 6% in the second, 5% in the third and so on.7 You might wonder why these surrender fees seem so punitive. The answer is simple and it's twofold:

- To discourage you from doing what many annuity owners want to do: leave!

- To recover the commission that was initially paid to the salesperson who sold you the contract.

How Do Variable Annuities Compare With Other Investments?

Unless purchased with protection riders, variable annuities offer essentially the same risk as a direct investment in mutual funds, but with higher fees. They also usually offer inferior levels of flexibility, liquidity, personalization and, crucially, return.

If you want performance from your retirement investments, then the fees associated with variable annuities are likely to disrupt your retirement plan.

Fisher Investments’ Annuity Counselors are available to offer complimentary evaluation services for qualified investors.8 We’ll analyze the annuities you own, or are considering, and help clarify exactly what these contracts truly provide.

Contact us today to schedule an appointment.

In the meantime, you can browse our extensive library of guides, which we designed to aid investors in understanding annuities and other retirement-planning subjects.

1 Source: Fisher Investments Annuity Evaluation Service, as of 3/10/2025. Based on average expenses of 26,547 unique annuity policies analyzed between 01/10/2020 – 12/31/2024. Common fees charged for a variable annuity include the following (with average annual rates): Mortality & Expense Risk (1.19%), Administration fee (0.18%) and fund expense of the underlying funds in a variable annuity (0.94%).

2 Source: Global Financial Data as of 3/21/2023. United States Consumer Price Index from 12/31/1925 – 12/31/2022, average annualized inflation was 2.94%.

3 Source: Securities and Exchange Commission as of 10/31/2018. Updated Investor Bulletin: Variable Annuities https://www.sec.gov/oiea/investor-alerts-and-bulletins/ib_variableannuities#Annuity_Fees

4 Source: Fisher Investments Annuity Evaluation Service, as of 3/10/2025. Based on average expenses of 26,547 unique annuity policies analyzed between 01/10/2020 – 12/31/2024. Common fees charged for a variable annuity include the following (with average annual rates): Fund expense of the underlying funds in a variable annuity (0.94%).

5 Source: Fisher Investments Annuity Evaluation Service, as of 3/10/2025. Based on average expenses of 26,547 unique annuity policies analyzed between 01/10/2020 – 12/31/2024. Common fees charged for a variable annuity include the following (with average annual rates): Guaranteed Minimum Death Benefit Rider fee (0.51%).

6 Source: Fisher Investments Annuity Evaluation Service, as of 3/10/2025. Based on average expenses of 26,547 unique annuity policies analyzed between 01/10/2020 – 12/31/2024. Common fees charged for a variable annuity include the following (with average annual rates): Guaranteed Lifetime Withdrawal Benefit Rider fee (1.06%).

7 Source: Securities and Exchange Commission as of 10/31/2018. Updated Investor Bulletin: Variable Annuities https://www.sec.gov/oiea/investor-alerts-and-bulletins/ib_variableannuities#Annuity_Fees