Flexible Investment Strategies

How Our Flexible Investment Approach Benefits Clients

No single investment category is right for all time. Instead, categories often trade leadership. In this video, Executive Vice President of Portfolio Management, Bill Glaser, explains how Fisher Investments takes advantage of these regular leadership rotations.

See Our Investment Guides

The world of investing can seem like a giant maze. Fisher Investments has developed several informational and educational guides tackling a variety of investing topics.

Is Your Investment Strategy Flexible, or Too Focused?

Portfolio managers, mutual funds and exchange-traded funds (ETFs) each have their own investment approach, sometimes focused on a narrow area of the market. They might invest only in certain asset classes like US stocks, non-U.S. stocks or high-yield bonds. Some may even target specific areas of the market, like small-cap growth. Some fund managers might focus on non-traditional investment strategies like ESG (environmental, social, and governance). Other portfolio managers have specific investment objectives like income, focusing their investment portfolios on assets that pay dividends—sometimes referred to as income funds.

Investment strategies can be broken into many different categories, such as:

- Asset class: stocks, bonds, cash and other securities

- Style: growth vs. value

- Size: large-, mid-, and small-capitalization companies

- Geographic Region: US, Non-US developed markets and emerging markets

The Importance of a Flexible Investment Strategy

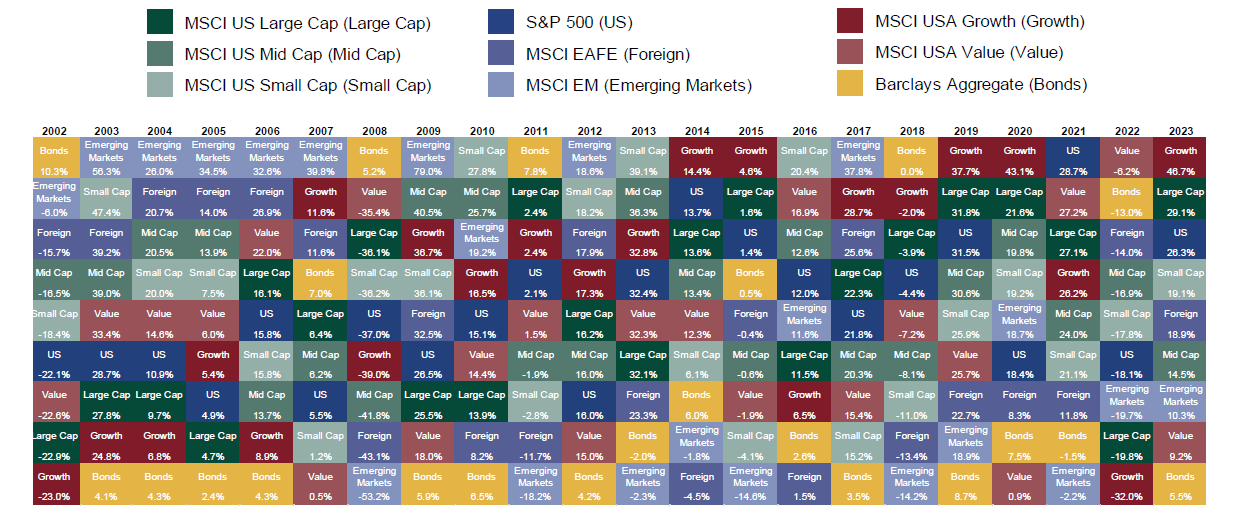

Investment categories cycle in and out of favor over time. Emerging markets outperformed all other categories from 2003 to 2007 and then dropped to the worst performer in 2008. What’s more, no predictable pattern exists to indicate which category will lead next. An investor risks missing significant portfolio growth by allocating a significant portion of their portfolio to a strategy focused on a single asset class, sector, market capitalization range or country, especially if that market segment performs poorly.

A snapshot of a portfolio manager’s past performance might seem impressive, but what happens when their narrowly focused investment strategy falls out of favor?

Investing only in one area of the market can be a risky gamble for investors. In our experience, investors sometimes get mesmerized by past performance, set aside their own investment objectives and choose to invest the bulk of their retirement assets in one asset or fund focused on a narrow segment of the market.

The chart below highlights the uncertainty inherent in capital markets. Each year brings a different combination of performance that cannot be predicted based on pattern or history.

No One Style Is Best for All Time

Source: FactSet, as of 1/15/2024. Gross total returns are presented from 12/31/2001 – 12/31/2023 for all of the following indexes: MSCI USA Small Cap, MSCI USA Mid Cap, MSCI USA Large Cap, S&P 500, Barclays Aggregate US Bond Index, MSCI USA Growth, MSCI USA Value, MSCI Emerging Markets and MSCI EAFE (Europe, Australasia, Far East). Investing in foreign securities may be subject to withholding taxes on divdends. All returns are presented in USD.

Research-Driven Agility

In our experience, no single strategy is always superior. Investors who do not adopt flexible multi-asset strategies risk underperforming the market because leadership styles continually rotate. Fisher Investments uses an active management approach. Our Investment Policy Committee and in-house research department make investment decisions based on evolving market conditions.

Our large investment team covers a wide range of asset classes, regions, countries, sectors and industries from a top-down perspective, creating flexible investment strategies for our clients. The investment team uses fundamental analysis to identify securities we believe are positioned to outperform their peers in the macroeconomic environment we expect. This flexibility allows us to adjust clients’ portfolios in volatile market conditions, positioning them for the best chance to help our clients reach their long-term goals.

For example, if interest rates rise and we believe certain categories of fixed income might underperform, we can allocate more to equities or choose different fixed income options.

When managing investments for our clients, we believe this comprehensive research approach allows us to diversify our clients’ assets across the market. Diversification can help capture potential investment opportunity and mitigate risk and volatility.

We base our active investing approach on our forward-looking view of markets. We make tactical adjustments along the way, moving investors’ portfolios into the types of assets we expect to perform best. This could mean:

- Shifting portfolio investments more to foreign stocks when we believe market conditions favor them more than US stocks.

- Favoring smaller or larger businesses depending on our view of the current stage in stock market cycle.

- Moving to defensive positions if we identify a bear market early on and believe a change in strategy will benefit our clients.

No money manager is correct every time, including Fisher Investments, but we believe the lessons we have learned from managing investments through many market cycles provide us invaluable insight to help our clients reach their long-term financial goals.