Business 401(k) Services / Plan Administration

401(k) Employee Services

Our high-touch, wealth generating participant service model enables better outcomes. Watch this short video to learn more.

Transcript

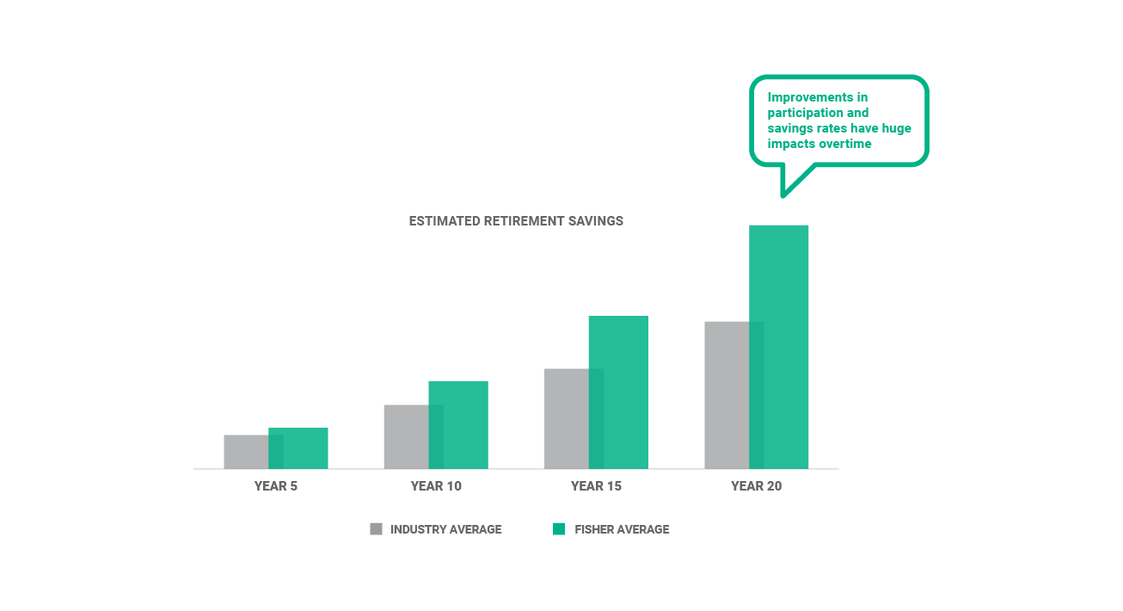

Female Voice: You want your employees to be set up for a successful retirement. While many advisors offer cookie cutter group education and enrollment meetings. Fisher offers one on one enrollment sessions: Where retirement counselors meet to help participants create an investment strategy that is unique to their individual goals. And provide guidance to help participants to tailor asset and sub asset allocation based on their individual goals. As a result, Fisher has 46% higher participation and 80% higher deferral rates. Improvements in participation and savings rates have huge impacts overtime.

Disclosure

A series of disclosures appears on the screen “Investing in Securities involves a risk of loss. Past performance is never a guarantee of future returns. Investing in foreign stock markets involves additional risks, such as the risk of currency fluctuations. The foregoing constitutes the general views of Fisher Investments and should not be regarded as personalized investment advice or a reflection of the performance of Fisher Investments or its clients. Nothing herein is intended to be a recommendation or a forecast of market conditions. Rather it is intended to illustrate a point. Current and future markets may differ significantly from those illustrated here. Not all past forecasts were, nor future forecasts may be, as accurate as those predicted herein.”

See our Business 401(k) Insights

Resources and articles to help your business with retirement plan support, optimization and administration.

Contact Us

One of our 401(k) business specialists would love to talk to you about your company's retirement plan needs.