Business 401(k) Services / Plan Administration

How to Find the Best 401(k) Provider

The best 401(k) providers play quarterback for your plan, coordinating vendors and the people at your company so that everything runs smoothly. Fisher 401(k) Solutions put together a list of questions to ask as you search for the right quarterback for your team

Transcript

How to Find the Best 401(k) Provider

Fisher Investments® 401(k) Solutions

[Upbeat music]

A man dressed in a suit speaks to the camera. A flyout in the lower left corner identifies him as Gary Peterson, VP Inside Sales

[The volume of the music is reduced]

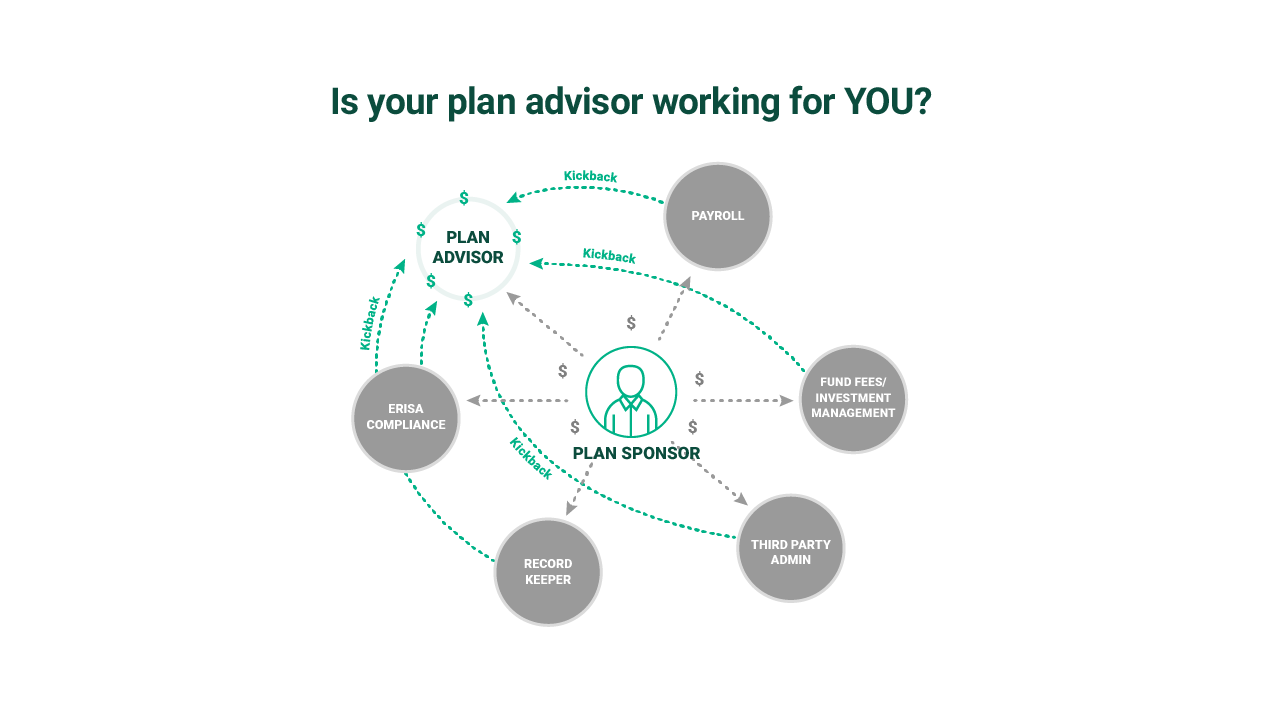

Male Voice: The most critical step when shopping for a 401(k) provider is to start with the advisor.

An advisor who is a specialist in the 401(k) industry is really going to be able to serve as a quarterback for you in terms of all of the other vendors that you might need to pull in; in order to create a very cohesive and highly functional plan.The camera zooms in as the man continues to speak.

A chart animates on screen from left to right.

The x-axis shows ages ranging from 25 and increases by 5s until 90 years. The Y-axis starts at $200,000 and increases by increments of $200,000 until the maximum of 1.2 million dollars. The chart includes two curves grey which peaks at $900,000 at the retirement age of 65 and then decreases to 0 by age 87.

Another green chart shows high savings at age 65 with a call out: Extra savings at Age 65 of $227,000 at the peak of the chart. Another call out indicates: Retirement Savings with 1% greater Returns.

A final call out: Extra Spending 15+ Years.

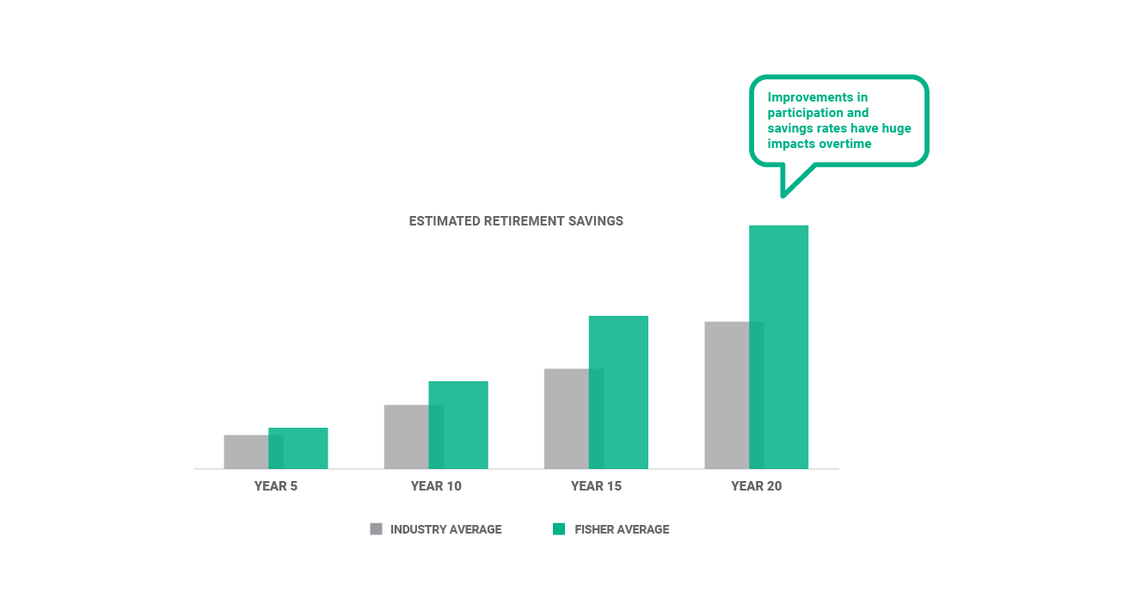

Finding the right plan advisor matters because when you look at investment performance a 1% improvement can mean up 17 years in extra retirement income for your employees.

The camera zooms back out.

Finding the right advisor starts with figuring out; are you dealing with a generalist or a specialist? A generalist is someone who focuses on retirement plans in their spare time. The majority of their clients are of other types. It’s just not something they have a lot of expertise in. In fact they are often leaning into third parties to add that expertise when they don’t have it.

A specialist is somebody who focuses solely on retirement plans. It’s what they do each and every day. All day long. This gives them the ability to provide a level of value-add that you’re just not going to find in dealing with someone who is a generalist.

The camera zooms back in.

A couple of key questions when shopping for a 401(k) plan advisor:

First, are they a generalist or a specialist? And an easy way to figure this out is to ask how many clients they serve in the 401(k) market. If you’re dealing with someone that’s got three, four, or five plans you’re likely dealing with a generalist. And not somebody who is going to be able provide the specialist level of service.

The camera zooms back out.

Another great question to ask, is whether the advisor has the ability to act as a 3(38) fiduciary. This is important because a fiduciary is legally required to put both you and your employees’ best interest first.

The camera zooms back in.

At Fisher Investments, we’re both a retirement plan specialist as well as a 3(38) fiduciary. We’re required to put your interests ahead of our own. So we do better when you do better.

White slides over the screen covering it.

Fisher Investment 401(k) Solutions logo fades on to the screen.

The volume of the upbeat music increases.

Fisher Investments 401(k) Solutions. Investing in securities involves the risk of loss. Intended for use by employers considering or sponsoring retirement. © 2021 Fisher Investments.

[Music]

Screen fades to black.

Music fades out.

See our Business 401(k) Insights

Resources and articles to help your business with retirement plan support, optimization and administration.

Contact Us

One of our 401(k) business specialists would love to talk to you about your company's retirement plan needs.