Business 401(k) Services / 401(k) Plan Optimization

The Trojan Horse That Can Crush Your Company's 401(k)

Your 401(k) plan might have a Trojan horse that can sabotage employees' earning potential and catch you and your participants off-guard only when it's too late.

Most 401(k) plans include several fund options in which your participants can invest. However, the fee structures of these funds are not all created equal. There are many types of fees associated with these funds, such as sales charges or management and administrative fees. These fees vary from fund to fund, and are most commonly calculated as a percentage of the net assets a shareholder has in that fund. Some are charged up front, some are charged when the fund is sold, and others are charged on an ongoing basis.

While every fund charges some sort of management fee, certain fees can cost you more than you may be aware. And funds with higher fees can sap away a significant amount of returns for investors over the long-term: As your assets grow, percentage-based fees grow as well. A fee that might have started as a fairly small cost will expand as your investment increases in value.

This affects compounding opportunities, too. The earlier that money is invested in your retirement savings efforts, the more time and opportunity it has to grow. But that growth is hindered if a high fund fee continually scrapes earnings—and growth potential—from your investments. Participants could be in for a harsh surprise when they're nearing retirement and realize money that could have been helping their retirement savings compound and grow was instead being paid out to fund fees.

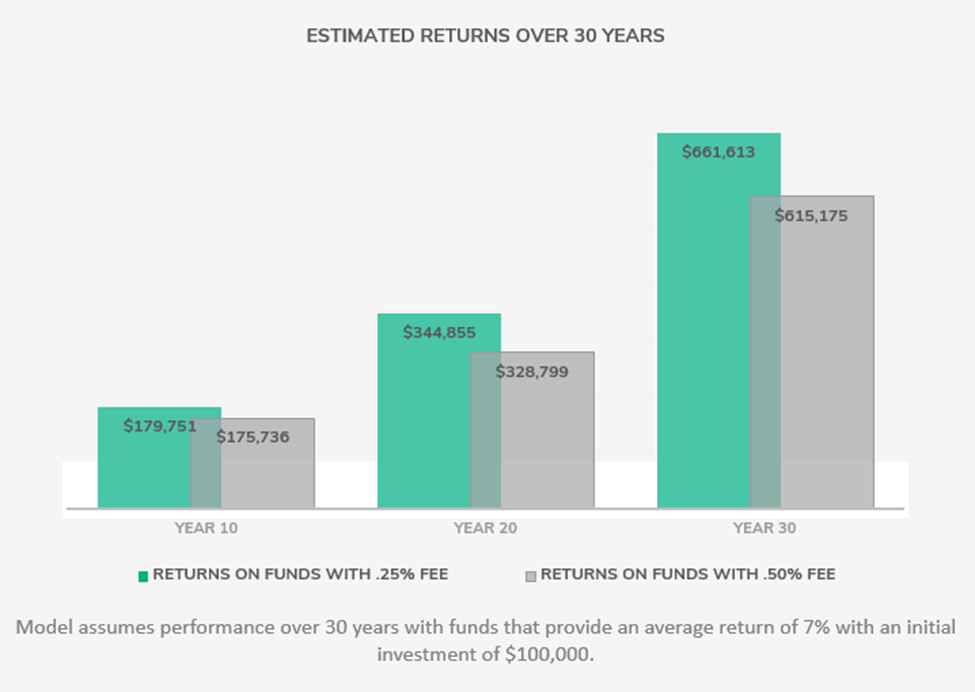

How big of an impact does a small percentage make? Well, even .25% could result in tens of thousands of dollars less in retirement savings. Let's see how .25% really impacts the growth potential of a 401(k) investment.

For this example, we'll look at how $100,000 could perform over 30 years in funds that provide an average return of 7%. And we'll see how that's impacted by a fund fee of .25% vs .50%.

For a fund that charges the fee of .25% a year, that initial investment would yield a net of about $661,613 in returns after 30 years. And the participant would have paid about $22,509 in fund fees over that period of time.

However, if that fund charged .50% a year, that initial investment would yield a net of just only $615,175 in returns after 30 years. And the participant would have paid a whopping $42,919 in fund fees.

Having funds in your 401(k) plan that charge high fees is a red flag. Not all advisors recommend funds in your best interest. High fund fees can be a tell-tale sign that your advisor is participating in revenue sharing.

What is revenue sharing? It's when a recordkeeper, third-party administrator, or advisor receives kickbacks, incentives, or commissions from each other or from the funds in your 401(k) plan. Your advisor might be including funds that charge high fees that give them a little bit of the cut.

It can be tricky to figure out whether or not your 401(k) partners are participating in revenue sharing. However, there's a simple way to see if the funds in your plan have been chosen with your best interests in mind: partner with a fee-only retirement advisor who acts as a ERISA 3(38) fiduciary—someone legally required to make decisions in the best interest of participants. Also, look for a plan advisor that commits in writing to receive no commissions or revenue sharing.

How do you find out how much you're paying in fund fees and if your advisor is participating in revenue sharing? Download our Complete Guide to 401(k) Costs to learn about fund fees, revenue sharing, and other costs that impact your plan and employees.

You can also contact Fisher—an investment adviser that is also an ERISA 3(38) fiduciary—for a complimentary fee analysis of your 401(k).

See our Business 401(k) Insights

Resources and articles to help your business with retirement plan support, optimization and administration.