Business 401(k) Services / Retirement Plan Options

Non-Profit Retirement Plan FAQs

Non-profit organizations have unique opportunities to help their employees save for retirement. Learn about your options and how to choose the right plan for your organization.

View Transcript

Non-Profit FAQs

Fisher Investments® 401(k) Solutions

Upbeat music

A woman dressed in a white blouse and navy-blue blazer speaks to the camera. A flyout in the lower left corner identifies her as Kimberly Ellis, Retirement Plan Specialist.

The volume of the music is reduced.

Female Voice: "Hi, my name is Kimberly Ellis. I'm a retirement specialist at Fisher Investments."

The flyout disappears. The camera remains focused on Kimberly as she speaks, gesturing occasionally.

"This means I spend a lot of time helping non-profit organizations improve their retirement plan. Here are a few common questions that I get."

A green flyout appears from the lower left with the question: "What's the difference between a 403(b) and 401(k)"

The flyout remains on-screen for a few moments before sliding back out.

"One: What types of retirement plans are available for non-profit organizations?"

"Typically, non-profits choose to sponsor either a 403(b) or a 401(k) plan. Many non-profits also choose to have a non-qualified deferred compensation plan, which can help their key employees save even more."

"Another question I hear is: What's the difference between a 403(b) and 401(k)?"

"401(k) and 403(b) are more similar than they are different. Both plans allow employees to save for retirement by putting away up to twenty-seven thousand dollars per year on a tax-deferred basis. However, only non-profit entities are able to sponsor a 403(b) plan. One advantage to a 403(b) plan is that they don't have to pass certain types of compliance testing. A disadvantage of a 403(b) plan is that they are limited in the types of investments they can use."

A green flyout appears from the lower left with the question: "How do I choose the right retirement plan for my non-profit?"

The flyout remains on-screen for a few moments before sliding back out.

"Another question I often hear is: How do I choose the right retirement plan for my non-profit?"

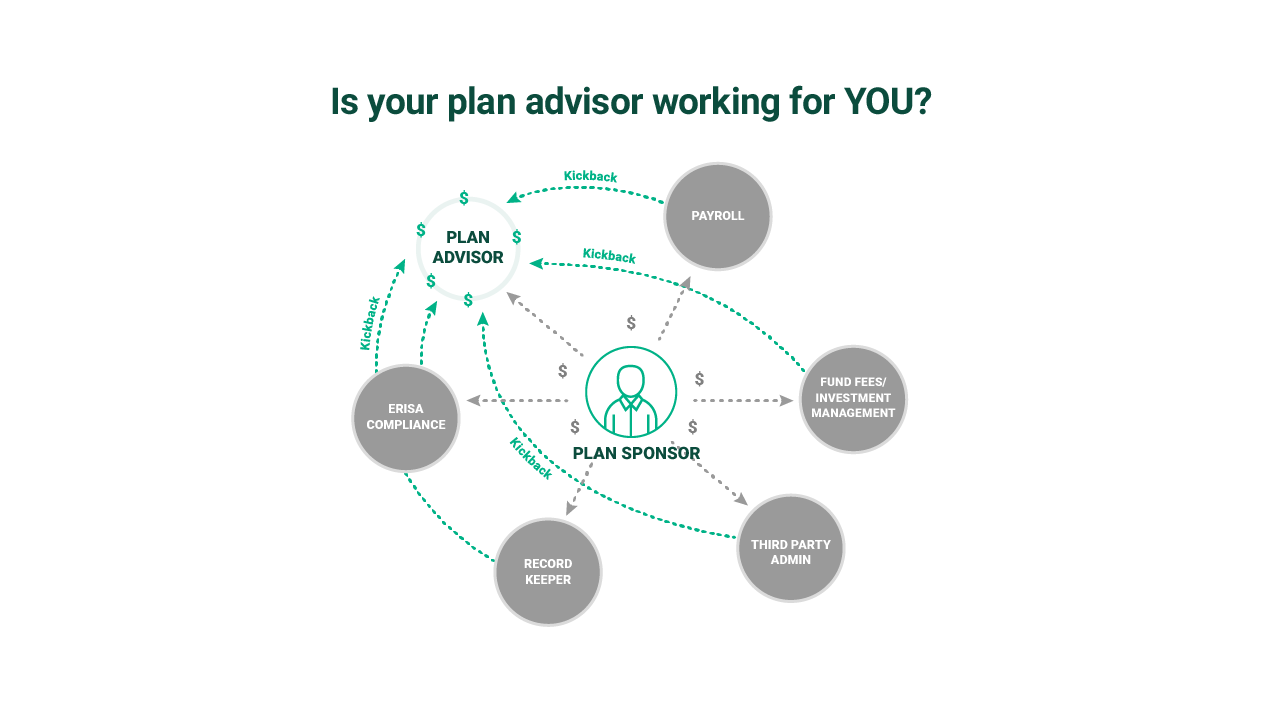

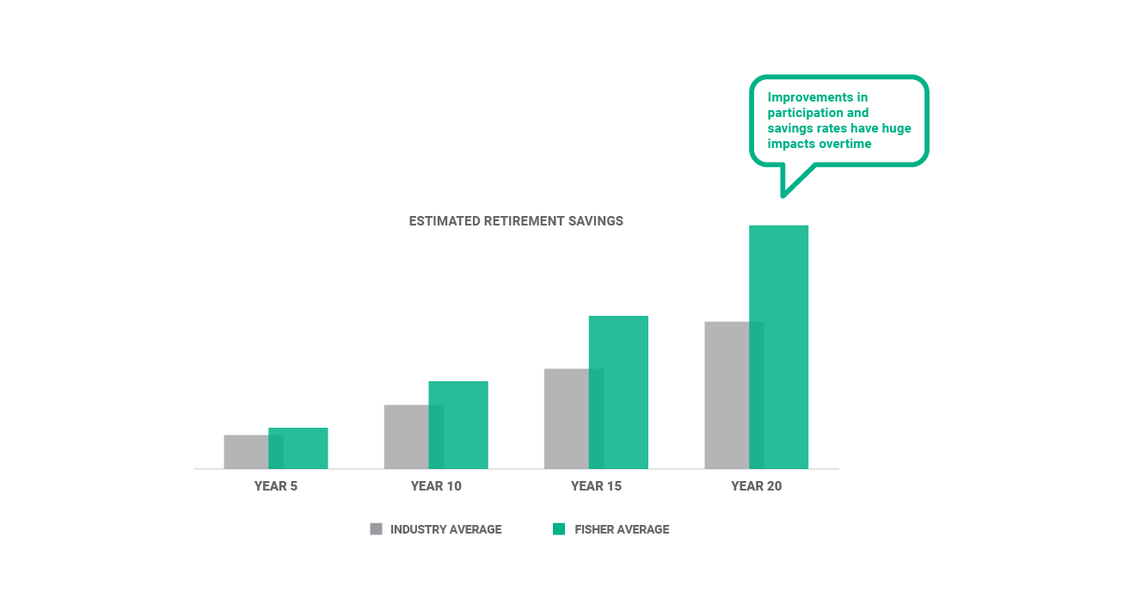

"The answer is: consult with an advisor who specializes in non-profit retirement plans. A specialized advisor can help you evaluate which type of plan is best suited for your organization, help you set it up, and, help you manage it."

"Fisher Investments has the expertise to help non-profit organizations set up and manage retirement plans that are tailored to get their employees the retirement they deserve."

White slides over the screen covering it.

Fisher Investment 401(k) Solutions logo fades on to the screen.

The volume of the upbeat music increases.

Fisher Investments 401(k) Solutions. © 2022 Fisher Investments. Investing in securities involves the risk of loss. Intended for use by employers, considering or sponsoring retirement plans; not for personal use by plan participants.

The music continues to play.

The screen fades to black.

The music fades out.

See our Business 401(k) Insights

Resources and articles to help your business with retirement plan support, optimization and administration.

Contact Us

One of our 401(k) business specialists would love to talk to you about your company's retirement plan needs.