Business 401(k) Services / Plan Administration

What Is a 401(k) Plan Document?

A 401(k) plan document governs a retirement plan’s features and day-to-day operations. Your plan document identifies what kind of plan it is, how it works, and what special features it has to customize it to your business’ needs and goals. While your 401(k) adviser may help draft and amend your plan document, as an employer you will decide what is contained in a 401(k) plan document.

What Should Be in a 401(k) Plan Document?

- 401(k) Plan Document – Plan Types and Features

- 401(k) Plan Document and Eligibility

- 401(k) Plan Document and Enrollment

- 401(k) Plan Document and Employee Contributions

- 401(k) Plan Document and Employer Contributions

- 401(k) Plan Document and Vesting Schedules

- 401(k) Plan Document and Named Fiduciaries

- 401(k) Annual Plan Review

401(k) Plan Document – Plan Types and Features

There are many potential combinations of features to make every employer-sponsored retirement plan unique, but at the core, every 401(k) fits into one of three general plan types:

-

Traditional 401(k)

A traditional 401(k) plan is the most flexible of the three types. If you’ve chosen to create a traditional plan, you will have the freedom to determine what, if any, contributions you will make as an employer to your employees’ accounts and how you’ll make those contributions. You can also choose to implement a vesting schedule. -

Safe Harbor 401(k)

These plans include an employer contribution to employee accounts that is vested immediately. Because of this, Safe Harbor plans are not subject to the non-discrimination tests traditional plans must pass each year. -

SIMPLE 401(k)

A SIMPLE 401(k) plan is a cost-efficient option for businesses with 100 or fewer employees. Like Safe Harbor 401(k) plans, SIMPLE 401(k) plans are not subject to non-discrimination testing, and require employer contributions to employee accounts that are immediately vested.

Your plan document will clearly identify which type you have and also outline any additional features you’ve chosen to customize your company plan. This can include features like auto enrollment, profit sharing, cash balance, and a Roth 401(k) option. 401(k) plan options like this can help you fine-tune your retirement benefit to fit your budget, your business goals, and the needs of your employees.

401(k) Plan Document and Eligibility

The next key component of your plan document will cover who is eligible to enroll in the plan and how enrollment works. The Internal Revenue Service (IRS) dictates that employees who are over 21 years of age and have at least one year of service are eligible to participate in their employer-sponsored retirement plan, though some plans have different rules for maximum service requirements.1

Within those restrictions, employers are free to define their own rules for eligibility in a plan document. For example, if you have a seasonal workforce with high levels of turnover, you may choose to require six months or more (up to the one-year limit) before employees can join your plan. On the other hand, if you are in a tight labor market and looking to attract new employees, you can allow employees to join the company plan immediately upon hire as an attractive perk.

401(k) Plan Document and Enrollment

Your plan document includes what enrollment periods look like for your employees. Commonly employers will choose an annual, quarterly, or monthly enrollment period for eligible employees. Your retirement plan adviser will help you make decisions that reflect the unique needs of your employees and your goals as an employer.

401(k) Plan Document and Employee Contributions

Your plan will outline how employees contribute money into their accounts. Elective deferrals are a common type of employee contribution in which employees have a certain percentage (or, in some cases, dollar amount) set aside from their pay for their retirement accounts.

401(k) Plan Document and Employer Contributions

With a traditional 401(k) plan, employers have the option to include an employer match or not. Your plan document will describe how your employer match works. For example, you may choose to match 100% of employee contributions up to 4% of their salary. Alternately, you might opt for a stretch match to encourage employees to save more, which might look like a 50% match up to 8% of an employee’s salary.

401(k) Plan Document and Vesting Schedules

If you’ve chosen a traditional 401(k) plan, your plan document will include the vesting schedule you’ve decided upon. A vesting schedule describes the amount of time an employee must wait before they completely own any employer contributions you’ve made to their account.

401(k) Plan Document and Named Fiduciaries

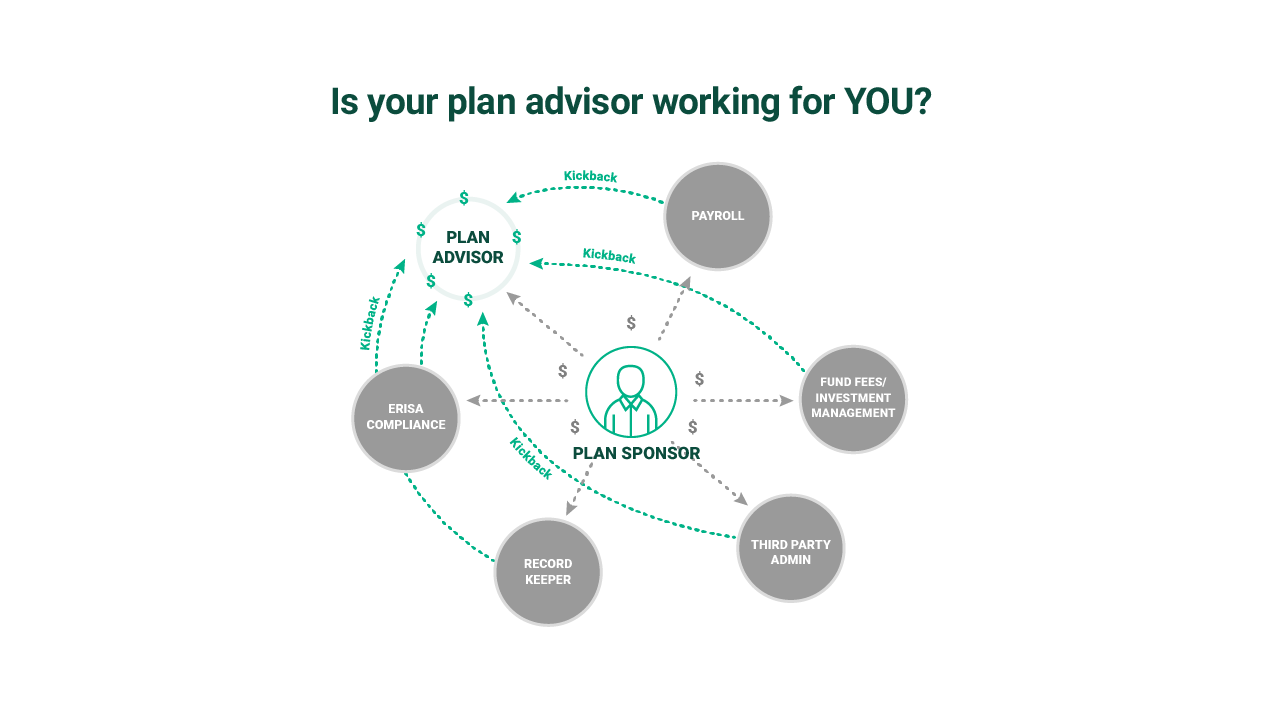

The plan document will name a person or a group acting as a fiduciary for the plan, which is usually a person or people who have a direct hand in plan management. If your company has an employee 401(k) committee to help guide and administer your plan, your plan document could designate the committee as a named fiduciary and would outline how the committee works. And while not every fiduciary may be named in your plan document, other people who are involved with plan management may also be fiduciaries to the plan.

401(k) Annual Plan Review

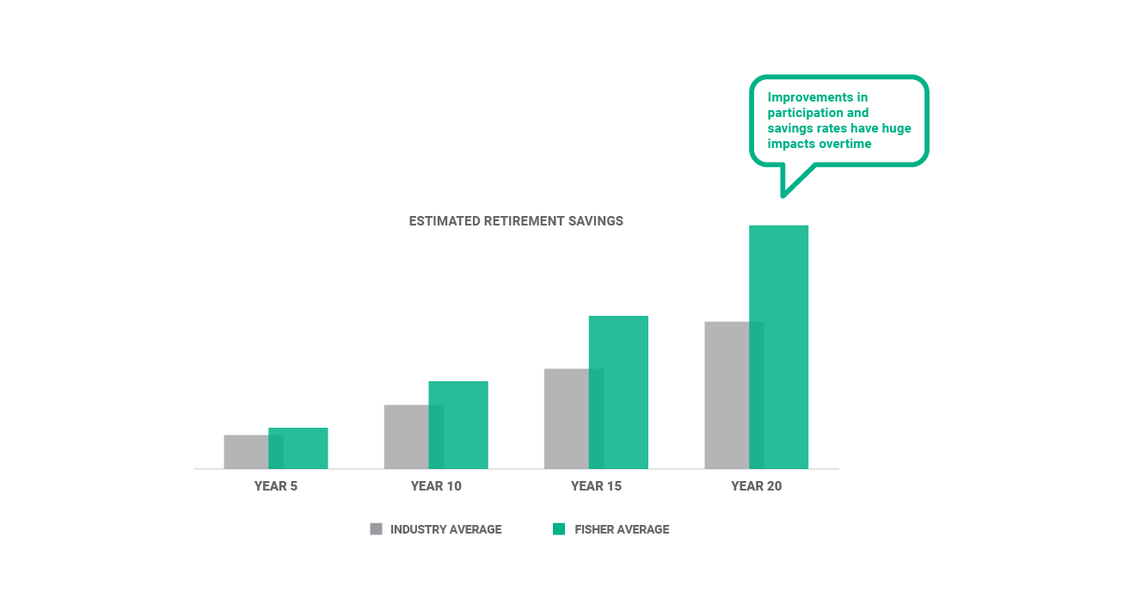

It’s a good idea to ask your retirement plan adviser to help you review your plan documents each year for compliance during your normal plan review. Reviewing your plan document is just one part of a broader plan review, which also includes looking at your fees, your investments, and your level of service and how they all align with your goals and the needs of your employees. As you conduct reviews, you’ll record your findings. You may choose to change the plan, in which case you would amend the plan document.

Get Help Drafting the Right Plan Document for Your Business

Find a 401(k) adviser that can help you understand your options so you end up with a 401(k) plan document that will meet your objectives and give your employees the tools they need to save for retirement. Visit our Plan Options overview to learn more about the many plan features you can consider for your company retirement plan.

1https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-who-can-participate-in-a-qualified-plan

See our Business 401(k) Insights

Resources and articles to help your business with retirement plan support, optimization and administration.