Business 401(k) Services / Plan Administration

Revenue Sharing: 4 Questions to Ask When Evaluating a Provider

Revenue Sharing: 4 Questions to Ask When Evaluating a Provider

Transcript

Revenue Sharing

Fisher Investments®

Upbeat Music

A white background appears green text with the question:

Does your plan advisor utilize investments that are free of commissions and revenue sharing?

The flyout stays on screen for several seconds and then disappears.

The volume of the music is reduced.

Male Voice: “Does your plan advisor utilize investments that are free of commissions and revenue sharing?”

An animation appears on screen.

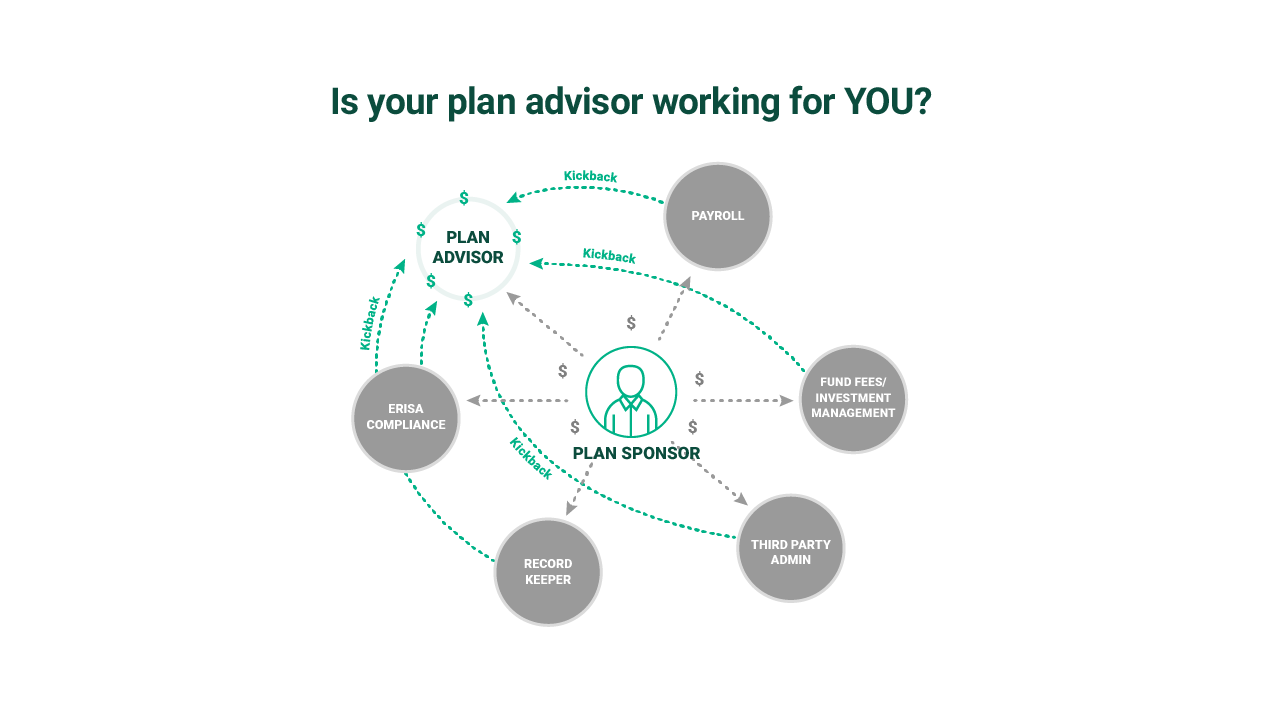

Many retirement plan advisors create complicated rings of dependence where referrals mean kickbacks and revenue sharing for the plan advisor. Rather than putting your interests first, these plan advisors create bloated administrative systems that allow them to get more money out of your company. You end up paying premium fees, but getting average-to-below-average service that doesn’t do enough to create wealth for plan participants.

Many of the most notorious examples involve mutual funds. Rather than relying on performance and low fees to sell their funds, some investment management companies offer kickbacks or commissions to plan advisors. Those plan advisors then stuff client portfolios with low-quality funds.

A man dressed in a suit speaks to the camera. A flyout in the lower left corner identifies him as Ian Epstein, National Director of Retirement Plan Consultants

The flyout stays on screen for several seconds and then disappears.

As a result, plan participants lose twice. The funds are likely to underperform and the fees are typically higher than average. The only one who wins is the plan advisor.

That’s why Fisher never accepts commissions or revenue sharing from providers.

A white background appears green text with the question:

Does your plan advisor pick the funds and take responsibility for the funds offered on your fund line up?

The flyout stays on screen for several seconds and then disappears.

Does your plan advisor pick the funds and take responsibility for the funds offered on your fund line up?

The camera goes back to the man as he continues to speak.

“If you are currently responsible for picking and monitoring your 401(k) plans, you are not working with a 3(38) Investment Manager. “

“A 3(38) Investment Manager takes on the full responsibility managing the investment lineup and has discretion to make necessary changes. In doing so, the 3(38) Investment Manager takes on the primary fiduciary responsibility for investment decisions.”

A flyout appears in the lower left that reads:

*Data from Dow Jones S&P Indices, Year End 2021

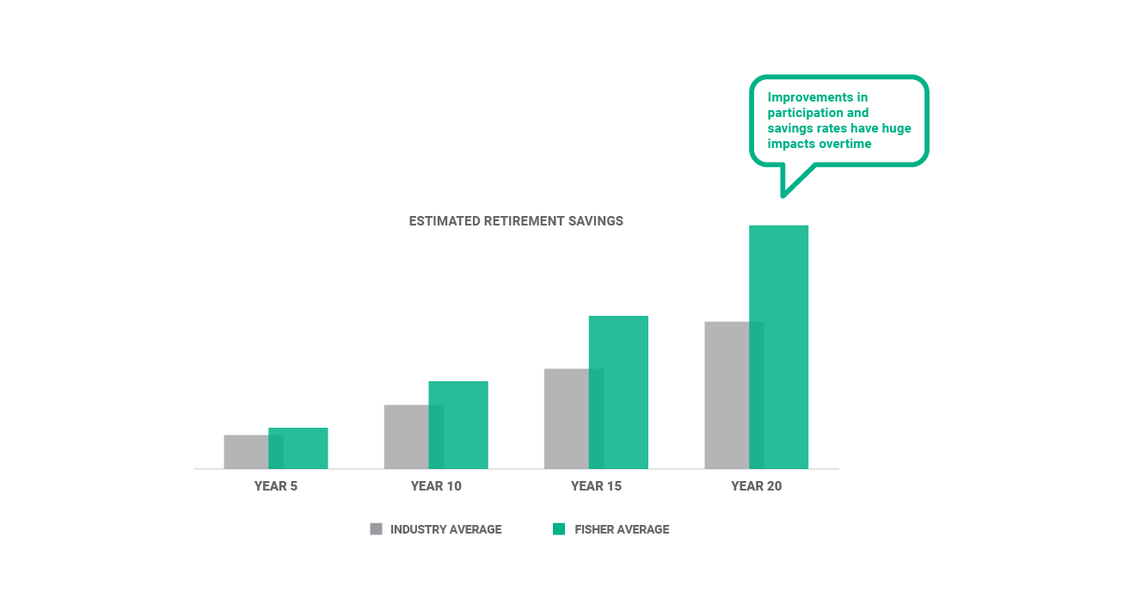

“Hiring a 3(38) Investment Manager that constantly monitors fund performance is important because few funds stay at the top of their category over time. For example, over a single five-year period, only about 15% of domestic equity funds that performed in the top half of their category in 2017 were able to maintain that status annually through 2021.”

A white background appears green text with the question:

Does your plan advisor offer individual goals-based investment discussions?

The flyout stays on screen for several seconds and then disappears.

“Does your plan advisor offer individual goals-based investment discussions?”

“Some advisors cloak the fact that they’re either not qualified or not allowed to offer individual goals based investment discussions with participants. At Fisher Investments we commit to individual goals based discussions that support better planning, investment selection, and retirement outcomes. Because when you do better, we do better.”

A white background appears green text with the question:

Is your plan advisor’s firm highlighted on any industry leader lists?

The flyout stays on screen for several seconds and then disappears.

“Is your plan advisor’s firm highlighted on any industry leader lists?”

“This is an important question because it can indicate whether you’re working with a 401(k) generalist or a specialist.”

The camera goes back to the man as he continues to speak.

“Many advisors tend to have a few retirement plans that fell in their lap over time. What most people know is that you’re way better off having a specialist versus a dabbler. In the retirement space it’s actually pretty easy to figure out which one you’re talking to. Most specialists will be recognized on the NAPA Top Defined Contribution Advisor List or holds a reputable specialist designation like CEFEX. At Fisher we’re recognized on both lists.”

A white background slides in from the right.

Fisher Investment 401(k) Solutions logo fades on to the screen.

The volume of the upbeat music increases.

Investing in securities involves the risk of loss. Intended for use by employers and their consultants, considering or sponsoring retirement plans; not for personal use by plan participants.

© 2022 Fisher Investments

The music continues to play.

The screen fades to black.

The music fades out.

See our Business 401(k) Insights

Resources and articles to help your business with retirement plan support, optimization and administration.

Contact Us

One of our 401(k) business specialists would love to talk to you about your company's retirement plan needs.